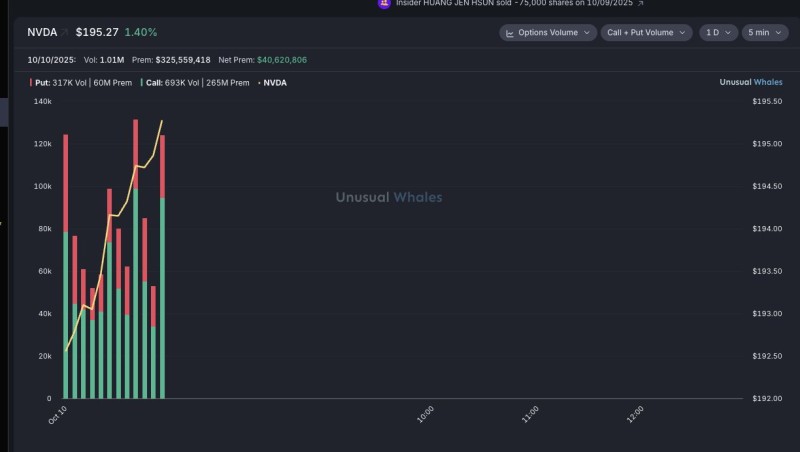

Nvidia (NVDA) shares gained momentum today, advancing nearly 1.5% while derivatives traders piled into the stock. The combination of steady price gains and surging options activity suggests the AI chipmaker remains at the center of market attention, with traders positioning for what could be another significant move.

Strong Options Activity Fuels the Rally

Nvidia, the dominant force in AI chip manufacturing, pushed higher today with a solid 1.5% gain. According to data from unusual_whales, options volume jumped well above normal levels, indicating that both institutional and retail traders are actively positioning around the stock.

This twin signal - rising prices alongside a derivatives surge - confirms that Nvidia continues to be one of Wall Street's most heavily traded names. The stock isn't just moving on fundamentals anymore; it's being driven by speculative positioning and volatility expectations.

The chart shows several constructive signs:

- Support levels are holding firm, giving buyers confidence

- A pattern of higher lows suggests sustained demand

- Options volume has spiked far beyond recent averages

- Bullish price action near resistance points to potential continuation

This setup hints at possible volatility expansion in the near term, especially if momentum builds further.

Why Nvidia Matters Right Now

Nvidia's strength isn't happening in a vacuum. The company remains the go-to supplier for GPUs powering artificial intelligence infrastructure, and data center demand shows no signs of slowing.

Earlier this year, strong earnings and raised guidance reinforced investor confidence, while the broader semiconductor sector has been riding tailwinds from improving supply chains and global chip demand. When options activity surges like this, it often signals large institutional moves - whether speculative bets or hedges against concentrated positions. Either way, it points to heightened conviction or concern.

What's Next for NVDA

If the momentum holds, Nvidia could push toward higher resistance zones soon. Options traders seem to be betting on upside, but the flip side is that derivatives activity can amplify swings in both directions. A clean break above current levels would strengthen the bullish case, while failure to hold support could trigger short-term choppiness. Either way, expect sharper moves than usual.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah