NVIDIA (NVDA) closed at $183.61 on Monday, gaining 3.93% in a powerful rally that continues its upward trajectory. The surge came after news broke that the company might invest up to $100 billion in OpenAI, further cementing its position as the dominant force in artificial intelligence infrastructure.

NVIDIA Extends Its Rally

The stock's performance reflects growing investor confidence in NVIDIA's AI strategy and its ability to capitalize on the expanding artificial intelligence market. NVIDIA didn't just hit a new intraday high but also closed strong, which signals genuine bullish momentum rather than just temporary buying pressure.

Market analyst Mimiru Usstock highlighted how this technical confirmation suggests the rally has solid foundations.

The company's graphics processing units remain essential for training and running AI models, making it indispensable to companies like OpenAI.

Chart Analysis: Strong Technical Momentum

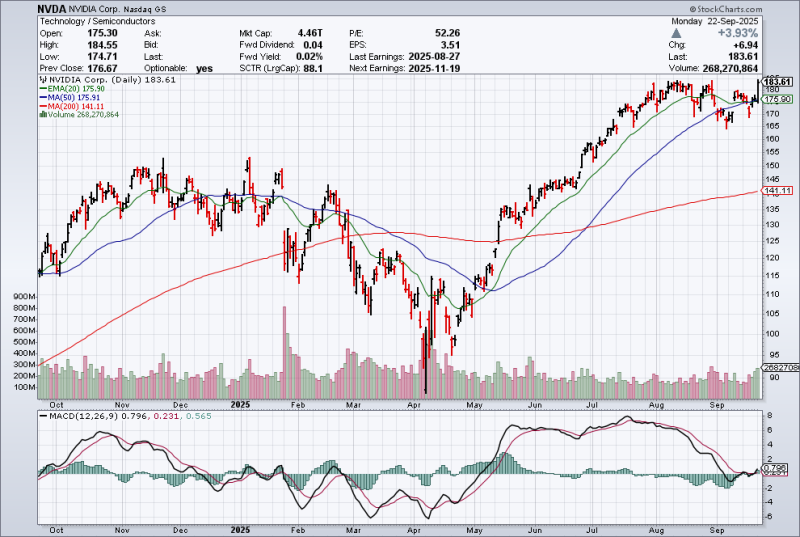

The daily chart reveals several bullish indicators supporting NVIDIA's upward move. The 50-day simple moving average at $175.91 provided crucial short-term support during recent pullbacks, while the 200-day average at $141.11 sits much lower, highlighting the stock's strong long-term trend.

Monday's rally pushed shares back toward their August peaks, testing key resistance around $183.50. The MACD indicator recently flipped positive again, suggesting momentum is building for another leg higher. Trading volume exceeded 268 million shares, indicating strong institutional participation in the move.

Why NVIDIA Is Rising

NVIDIA's dominance in AI hardware continues to drive investor enthusiasm. The company supplies the critical GPU infrastructure that powers artificial intelligence applications, making it the backbone for companies developing advanced AI systems. The reported $100 billion OpenAI investment showcases NVIDIA's ambition to expand beyond pure hardware sales into broader AI ecosystem development.

Additionally, the broader market rotation toward AI-focused stocks has benefited NVIDIA as demand for computational power continues accelerating across industries. The company's strategic positioning at the center of the AI revolution makes it a compelling investment for institutions betting on continued AI growth.

What's Next for NVIDIA?

- Bullish scenario: A breakout above $185 could open the path toward $190-$200

- Neutral scenario: Sideways trading between $175-$185 would still confirm trend strength

- Bearish scenario: A drop below $175 might trigger profit-taking toward $160 support

The technical setup favors continued upside, but investors should watch for any signs of exhaustion at current levels. NVIDIA's fundamental story remains strong, but the stock's recent gains may need time to consolidate before the next major move higher.

Peter Smith

Peter Smith

Peter Smith

Peter Smith