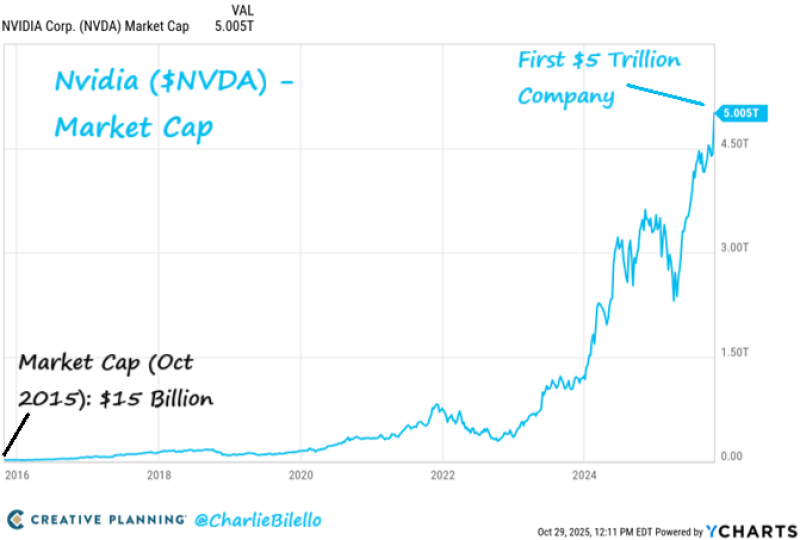

In just one decade, NVIDIA ($NVDA) pulled off something that once seemed impossible—going from a $15 billion chipmaker to the world's first $5 trillion company.

A Decade of Unprecedented Growth

A chart shared by Charlie Bilello captures this historic moment perfectly: nearly flat growth through most of the 2010s, followed by an almost vertical climb in the 2020s. NVIDIA's market cap has exploded 335-fold in ten years.

This isn't just about one company winning big—it's about how artificial intelligence has become the new industrial revolution.

The chart tracks NVIDIA's market cap from 2016 to 2025, showing one of the steepest corporate climbs in history.

2015–2019: The Calm Before the Storm Back in October 2015, NVIDIA was worth just $15 billion, mostly known for gaming GPUs. The stock traded quietly, catching little attention outside tech circles.

2020–2022: The Turning Point The pandemic pushed digital transformation into overdrive. NVIDIA's GPUs became essential for data centers and early AI work. By late 2022, the company had crossed $1 trillion—a milestone that took Apple nearly 40 years to hit.

2023–2025: The AI Supercycle From 2023 on, the chart goes nearly vertical. NVIDIA's chips—especially the H100 and Blackwell processors—became the foundation of global AI infrastructure, powering everything from ChatGPT to national supercomputers. By October 2025, NVIDIA hit $5.005 trillion.

Why NVIDIA's Rise Is Different

NVIDIA's trajectory stands apart from past tech giants for several key reasons:

- AI as the New Electricity – NVIDIA's GPUs have become the universal engine for artificial intelligence, powering everything from chatbots to self-driving cars. Like electricity in the 1900s, AI now runs through every modern industry.

- Data Center Dominance – More than three-quarters of NVIDIA's revenue now comes from data centers. Partnerships with Amazon, Microsoft, and Google have made it the go-to infrastructure provider for global computing.

- Software Ecosystem Lock-In – NVIDIA's CUDA platform and AI frameworks have built a developer moat that's nearly impossible for competitors to break through, ensuring long-term loyalty and recurring revenue.

- Capital Efficiency – Unlike traditional giants, NVIDIA scales through IP and software leverage, not heavy manufacturing. Its chips are made by TSMC, allowing faster growth with lower capital costs.

- Historical Context – Apple reached $3 trillion in 45 years. Microsoft hit $3.3 trillion in 49 years. NVIDIA reached $5 trillion in just 32 years—and most of that growth happened in the last five.

What It Means for Markets

NVIDIA's rise to $5 trillion isn't just a company story—it's a signal of where the economy is heading.

AI as a New Asset Class Artificial intelligence is no longer just a tech trend—it's a structural investment category, similar to the internet boom or industrial expansion of the last century.

Challenging Traditional Valuation As pointed out, NVIDIA's 335x increase over ten years challenges old-school valuation logic. The lesson? "There is no impossible in markets." Growth once dismissed as unsustainable has become the new normal in an age of exponential innovation.

Broader Ripple Effects NVIDIA's success is already driving massive capital flows into AI hardware, sovereign AI infrastructure, and edge computing—sectors racing to replicate its ecosystem dominance.

The chart doesn't lie: NVIDIA's journey from $15 billion to $5 trillion in a decade is one of the most dramatic corporate transformations in history. And if AI continues its trajectory, this might just be the beginning.

Usman Salis

Usman Salis

Usman Salis

Usman Salis