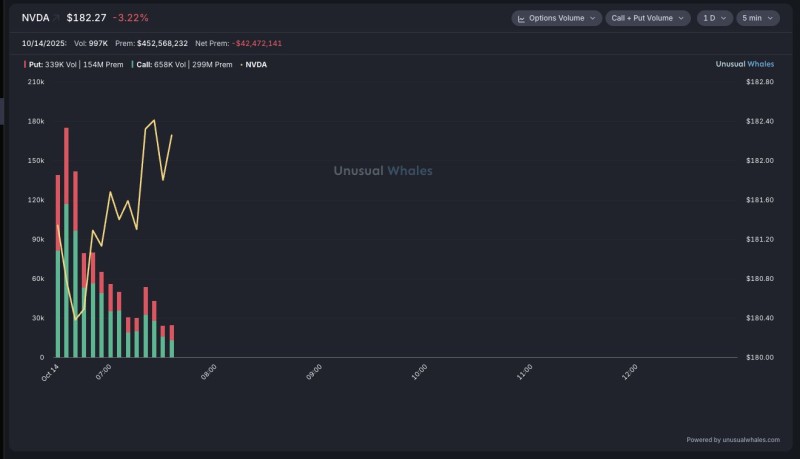

Nvidia (NVDA) continues to be one of the most closely watched stocks in the market, particularly as AI enthusiasm collides with broader tech sector volatility. On October 14, the stock slipped 3.22% to $182.27, but it wasn't just the price move that caught traders' attention - it was the massive surge in options activity that revealed a market bracing for uncertainty.

Options Market Signals Mixed Sentiment

According to data from unusual_whales, Nvidia saw nearly 997,000 options contracts change hands in a single session. Call options dominated the volume with 658,000 contracts and $299 million in premium, while put options accounted for 339,000 contracts totaling $154 million.

However, despite heavier call volume, net premium ended the day at –$42 million, suggesting that institutional players may be hedging positions or selling into strength rather than making aggressive bullish bets.

Technical Picture Shows Weakness

The stock opened under pressure, with early selling driving it down toward $181.20 before a modest bounce. Although options demand spiked sharply, price action struggled to break back above resistance near $182.80. This disconnect between rising options interest and weakening price momentum reflects a market that's speculating on volatility rather than committing to a clear direction.

What's Weighing on Nvidia

Several factors are contributing to the stock's recent struggles. Valuation remains a concern after the AI-driven rally pushed NVDA's multiple well above many of its peers. Broader macro uncertainty, including rising interest rates and ongoing tech sector volatility, continues to pressure high-growth names. Additionally, intensifying competition in the chip space and geopolitical risks around semiconductor supply chains are adding to investor caution.

What Traders Should Watch

Nvidia remains a favorite among AI-focused traders, and the surge in options volume shows that big moves could be on the horizon. Key technical levels include support around $180 and resistance at $183. While call buyers suggest some optimism, the negative premium flow points to institutional caution. For anyone holding or trading NVDA, staying aware of volatility and managing risk will be critical in the sessions ahead.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah