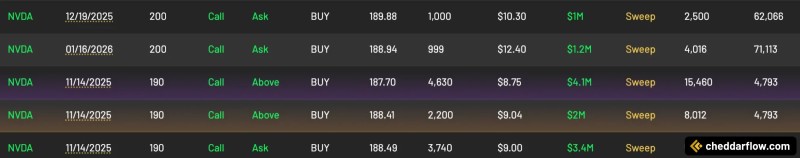

The options market around NVIDIA (NVDA) is heating up again. Unusual flow data shows traders aggressively buying large call contracts, with orders ranging from $1 million to $4 million across multiple strike prices. The scale of these moves points to strong institutional conviction that the stock has room to run.

NVIDIA Options Activity Points to Strong Bullish Sentiment

According to data from Cheddar Flow, traders are securing exposure to NVIDIA's upside through both near-term and extended contracts.

The positioning is concentrated around the $190 and $200 strikes, with expirations stretching from November 2025 into January 2026. These aren't speculative lottery tickets - they're sizable, urgent sweeps suggesting immediate appetite for market exposure. When you see call buying at this level, it typically signals that larger players expect catalysts ahead, whether that's earnings beats, product announcements, or sustained AI-driven demand.

What's Driving the Bullish Bets

The enthusiasm makes sense when you look at the fundamentals. NVIDIA's GPUs remain essential infrastructure for AI development and training. Data center expansion continues to drive record hardware demand, and the company keeps beating earnings estimates with optimistic guidance. They're not just leading the AI chip space - they're dominating it, with an ecosystem advantage that competitors struggle to match.

What This Means for the Stock

With heavy call positioning near $190–$200, these levels could act as magnets if momentum continues. Large option inflows often create their own volatility through dealer hedging, potentially amplifying moves in either direction. The fact that contracts extend well into 2026 suggests this isn't just short-term speculation - traders are betting on sustained strength.

Takeaway

NVIDIA's dominance in AI chips is showing up not just in stock performance but in how traders are positioning. Multi-million dollar call sweeps reflect serious conviction that the company's growth story has legs. While no trade is risk-free and large option flows can sometimes precede pullbacks, the long-dated nature of these bets signals confidence in NVIDIA's trajectory through next year and beyond.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir