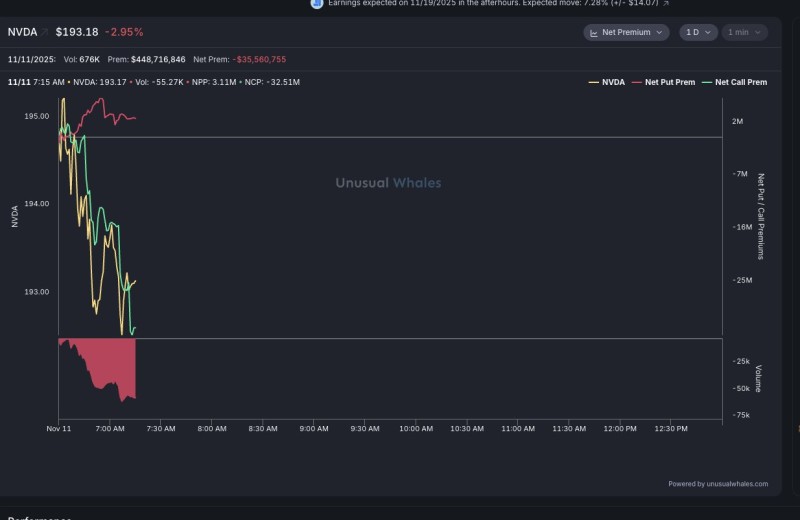

⬤ Nvidia (NVDA) dropped almost 3% today, trading near $193 after opening with immediate downward pressure. The price action and options flow both point to a noticeable cooling in sentiment—at least for now.

⬤ Net premium on NVDA options has fallen to roughly –$35.56 million, showing a clear tilt toward bearish positioning. The stock slipped from above $195 into the $193 range early in the session, with call premium deeply negative and put activity adding fuel to the decline. Broader market chatter around potential tax policy changes is also creating some uncertainty for high-growth tech names, though nothing directly targets Nvidia yet.

⬤ Today's drop seems more about options positioning than any fundamental news, but the negative premium flow suggests traders are getting cautious ahead of upcoming catalysts. Even vague concerns about regulatory or tax shifts can weigh on sentiment when volatility picks up.

⬤ For investors, the combo of a sharp pullback and unusually bearish options activity is worth noting. NVDA remains a heavyweight in semiconductors and AI, so shifts in options flow like this often act as early warning signs. Whether this pressure sticks around or fades before earnings is the question everyone's watching now.

Usman Salis

Usman Salis

Usman Salis

Usman Salis