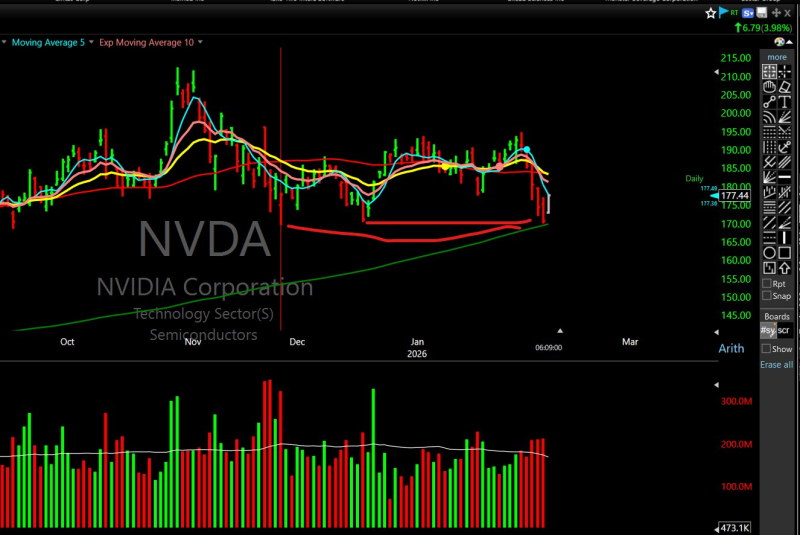

⬤ NVDA pulled a classic fake-out move, slipping below the bottom of its consolidation pattern before immediately reversing course. The stock undercut key support levels and then caught a bid right at the 200-day moving average—exactly where the technical playbook says buyers should show up.

⬤ The price action tells the story: shares dipped beneath recent support, looked like they might roll over, then snapped right back above the breakdown point. That bounce came directly off the long-term moving average, suggesting institutions stepped in at that level.

The stock undercut both support levels and then bounced from the 200 day moving average.

⬤ After the whipsaw, NVDA climbed back into its previous trading range. The 200-day MA did its job as a technical floor where buyers decided the dip was worth taking.

⬤ Why it matters: when a major name like Nvidia tests and holds a widely-watched technical level like the 200-day, it typically influences how traders position themselves short-term. The reversal off that support could shift momentum if it holds.

Peter Smith

Peter Smith

Peter Smith

Peter Smith