All eyes are on Nvidia today as the AI powerhouse gets ready to unveil its latest earnings. With data center revenue growing at an unprecedented pace and the entire tech sector hanging on every word, this earnings report could shake up markets far beyond just semiconductor stocks.

Nvidia (NVDA) Price Anticipation Ahead of Earnings

Wall Street is holding its breath for what could be another market-moving earnings event. Nvidia, the undisputed king of the AI boom, reports its latest numbers today—and the results could send shockwaves through the entire stock market.

With AI demand hitting fever pitch, investors are watching Nvidia like a hawk. The company has become more than just a chip maker; it's essentially a barometer for the whole AI revolution and tech sector health.

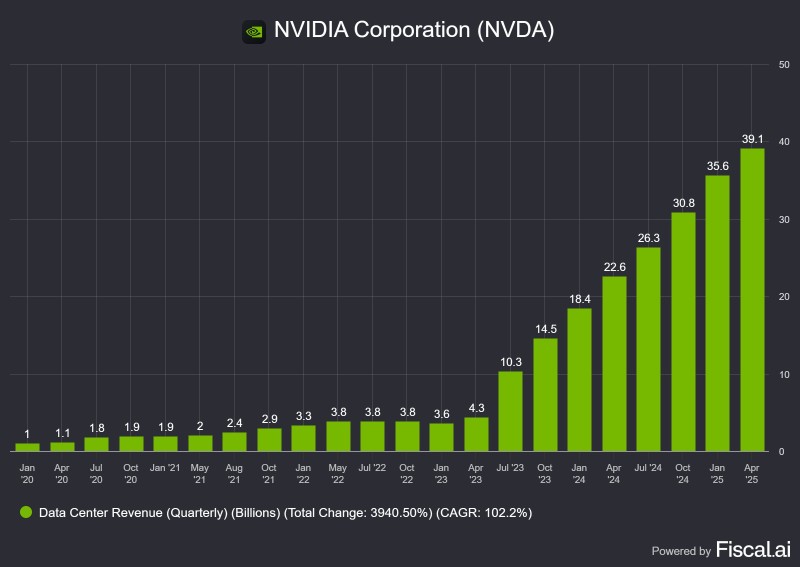

Market analyst @itsTarH pointed out something pretty mind-blowing about Nvidia's data center business growth, noting that what management says about the future might matter just as much as the actual numbers. Their guidance could literally steer both NVDA's stock price and the broader market's direction.

The numbers are honestly jaw-dropping. In just over five years, Nvidia's data center revenue went from a modest $1 billion to a staggering $39.1 billion. That's a 3,940% increase—or roughly 102% growth every single year.

Here's how wild this journey has been:

- January 2020: Started at $1.0B

- April 2023: Hit $4.3B as AI really took off

- July 2023: Jumped to $10.3B—first time in double digits

- April 2024: Soared to $22.6B

- April 2025: Peaked at $39.1B, cementing total market dominance

This isn't just growth—it's a complete transformation. Nvidia has basically become the foundation that powers AI everywhere, from massive tech company data centers to business cloud services.

What Earnings Mean for Nvidia (NVDA) Price and Markets

Today's earnings aren't just about celebrating past wins—they're about whether this incredible run can actually continue. When you're already growing this fast, maintaining momentum becomes the million-dollar question.

If things go well and Nvidia delivers strong future guidance, the stock could hit new records and pull the whole market up with it. The Nasdaq and S&P 500 would likely celebrate right alongside.

But there's a flip side. Any hint that growth might be slowing, supply chain hiccups, or softer demand could trigger some serious market turbulence. Given how much weight Nvidia carries in major indexes, a stumble could drag everything down.

Peter Smith

Peter Smith

Peter Smith

Peter Smith