NVIDIA (NVDA) just got a major endorsement from Wall Street. HSBC upgraded the stock from Hold to Buy and raised its price target from $200 to $320. It's a clear signal that institutional money sees more upside ahead, driven by the company's grip on AI infrastructure and accelerating demand across multiple sectors.

HSBC Upgrade: Why It Matters

Investing.com trader NVIDIA notes that HSBC's move isn't just about numbers - it's about conviction.

NVIDIA sits at the center of the AI buildout that's reshaping tech. High-performance GPUs are flying off the shelf for everything from cloud computing to autonomous systems to platforms like ChatGPT.

This kind of price target jump suggests analysts expect NVIDIA's momentum to hold. The $320 mark would mean significant gains from where the stock trades now, and it reflects confidence that adoption curves are still in their early innings.

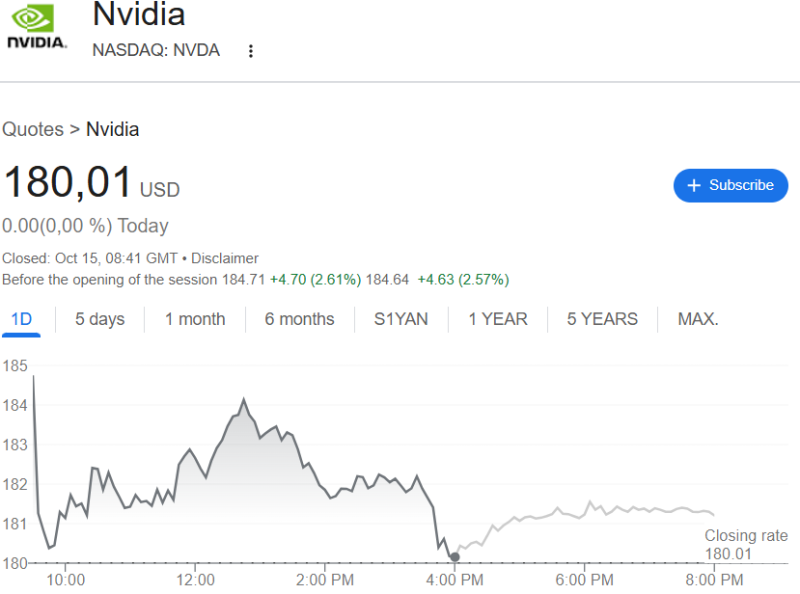

Chart Analysis: NVIDIA Builds Momentum

Technically, NVDA is setting up well. The stock has held firm above $200, even when broader markets got shaky. That level has become a floor, showing buyers are willing to step in. Now the action is around $250–$260, which has been a stubborn ceiling. If NVIDIA can break through and hold above that zone, the path to $320 opens up. Since late last year, the stock has been making higher lows - a classic sign of accumulation. Volume has picked up on the rallies too, which tells you institutions are backing the move, not just retail chasing headlines. The technical picture lines up with the bullish case HSBC is making.

Market Drivers Behind NVIDIA's Strength

There are real reasons why upgrades keep coming. NVIDIA's GPUs are still the gold standard for training and running large AI models. Hyperscale cloud providers are ordering chips in record volumes to keep up with enterprise and consumer AI demand. The use cases keep expanding - generative AI, autonomous vehicles, drug discovery, you name it. And after a period of consolidation, the valuation doesn't look stretched relative to where growth is headed. That combination of leadership, demand, and reasonable pricing is what gets analysts excited.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir