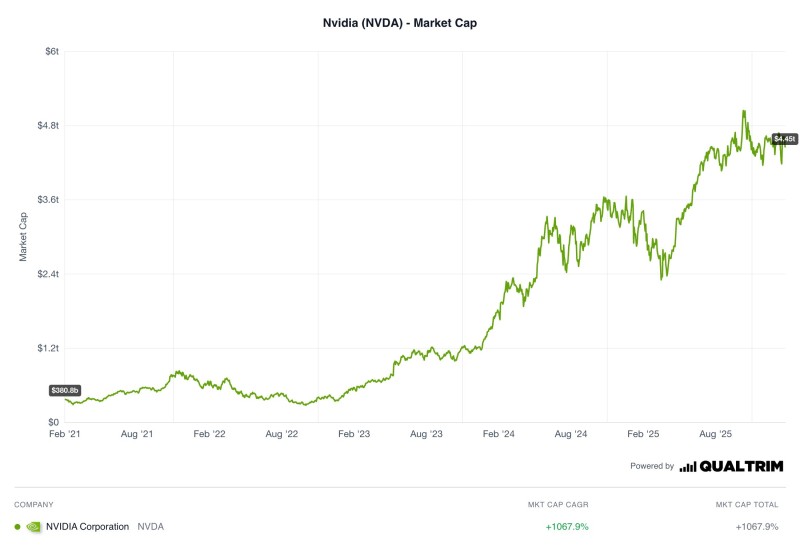

⬤ NVDA has grown into a corporate giant whose market value now matches the scale of entire national economies. The chip maker's market cap recently hit approximately $4.45 trillion, placing it among the most valuable companies in history.

⬤ The numbers tell a remarkable growth story. Back in early 2021, Nvidia's market cap sat around $380.8 billion. Then things accelerated. The company blew past the trillion-dollar mark in 2023 and kept climbing through 2024 and into 2025. All told, the stock has surged more than 1,067.9% over this period. The company recently achieved another milestone when market cap tops $4.5 trillion, cementing its position as a market leader.

⬤ The growth pattern shows extended flat periods followed by sharp upward bursts, with the steepest gains coming after 2023. To put this in perspective, Nvidia is now worth 16% of U.S. GDP, a comparison that underscores just how massive the company has become relative to the entire American economy.

⬤ Why does this matter? When a single company's valuation approaches the economic output of major nations, it signals a shift in how wealth and value are concentrated in the modern economy. Tech giants like Nvidia aren't just big businesses anymore—they're operating at a scale that rivals countries. This phenomenon raises important questions about market concentration, systemic risk, and the growing influence of a handful of technology companies in the global financial system. The AI boom has turbocharged this trend, with Nvidia positioned as the primary beneficiary of the world's rush to build artificial intelligence infrastructure.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah