Wall Street has been buzzing about NVIDIA CEO Jensen Huang's recent stock activity, and it's not what some social media posts might have you believe. Fresh SEC filings paint a clear picture: Huang is selling shares, not buying them. Throughout late October, the CEO has been systematically offloading significant chunks of his NVDA holdings, raising questions about what this means for investors riding the AI wave.

Pattern of Steady Sales Emerges from SEC Filings

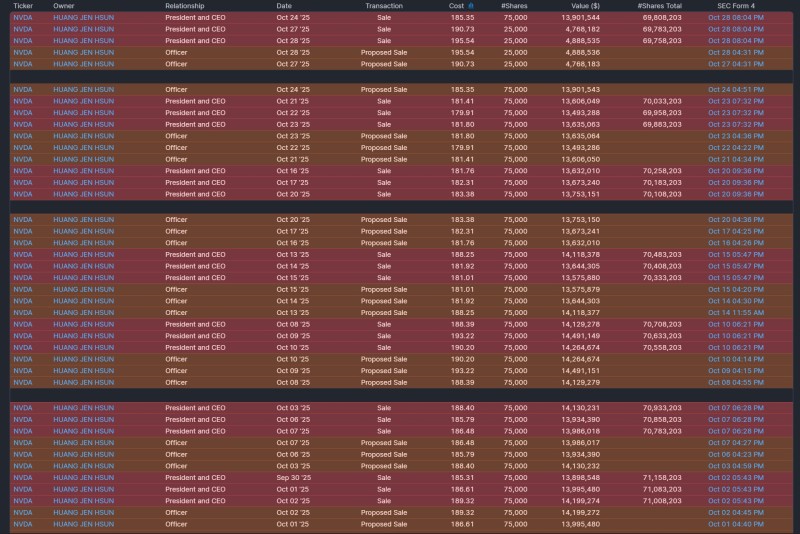

Trader The Maverick of Wall Street recently called attention to what the paperwork actually shows. Multiple Form 4 filings through late October reveal Huang disposing of 75,000-share blocks in nearly every transaction, with prices hovering between $181 and $195 per share.

We're talking about $13 million to $15 million per sale, with some transactions in the October 27-28 window alone exceeding $4.8 million. The pattern has been remarkably consistent throughout the month, with sales happening every few trading days. Despite this ongoing liquidation, Huang still maintains ownership of more than 69 million shares, so he's hardly abandoning ship.

What Insider Selling Really Means

Key considerations for investors:

- Executives often sell stock through pre-scheduled trading plans for diversification or compensation

- Large-scale disposals during high valuations can signal caution about near-term peaks

- Persistent selling may create psychological resistance levels and encourage broader profit-taking

- The CEO's substantial remaining stake demonstrates long-term commitment to the company

Market Context and Technical Implications

NVIDIA's stock has been on a tear, fueled by insatiable demand for AI accelerators and data center chips. The company's valuation has climbed to levels that have some analysts scratching their heads, wondering if the growth trajectory really justifies these multiples. Huang's selling activity, while potentially routine for someone with massive equity compensation, adds fuel to that debate. The timing is particularly notable given the post-earnings volatility and the fever pitch of AI-sector enthusiasm. These sales seem to be creating technical resistance around the $190-195 range where most transactions occurred, potentially acting as a psychological ceiling for the stock in the near term.

Reading Between the Lines

The contrast between social media hype and actual filing data is stark. While online chatter suggested Huang might be buying after talking up the company, the SEC documents tell a different story entirely. This disconnect highlights the importance of checking official sources rather than relying on speculation. For traders and investors, the key question is whether this selling cadence represents routine executive compensation management or something more meaningful about leadership's view of current valuations.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi