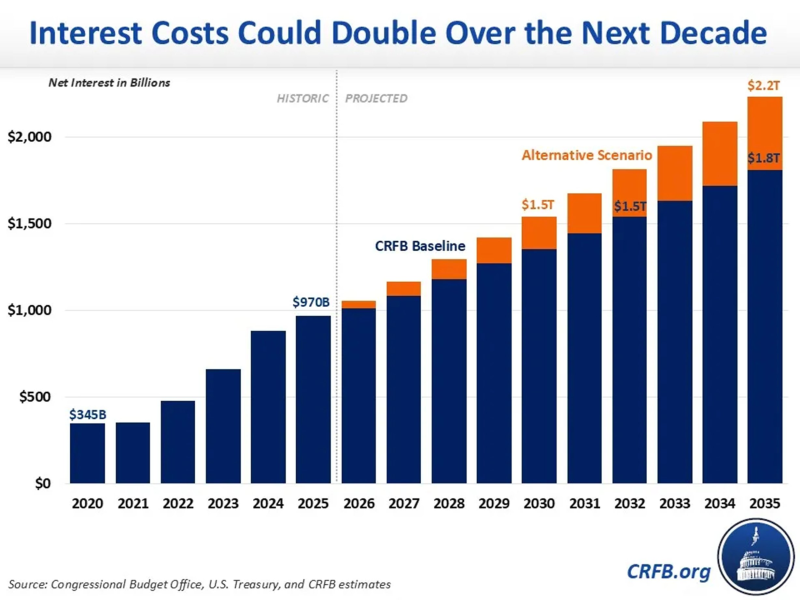

⬤ The U.S. is staring down some serious interest bills in the years ahead. New projections show that annual interest payments on public debt are expected to nearly double to around $1.8 trillion over the next decade. That's assuming Washington keeps borrowing at its current pace of roughly $2 trillion a year. To put that in perspective, it's more than four times what the government was paying in 2021.

⬤ The numbers paint a clear picture: interest expenses are climbing steadily from today's levels and heading toward that $1.8 trillion mark by 2035. We're looking at approximately $970 billion in interest payments for 2025 alone, and those costs just keep pushing higher as the total debt pile grows and servicing payments expand right along with it.

⬤ There's also a worst-case scenario on the table. If things go south with borrowing trends, annual interest payments could balloon to about $2.2 trillion—that's a 450% jump from 2021 levels. The gap between the baseline and pessimistic projections widens significantly in the later years, showing just how much impact shifting borrowing patterns could have on the final bill.

⬤ Because interest obligations are eating up a bigger chunk of the federal budget every year. With costs already at historic highs and climbing, the government's debt servicing burden is becoming a major piece of the fiscal puzzle, adding pressure that's only going to intensify over the long haul.

Peter Smith

Peter Smith

Peter Smith

Peter Smith