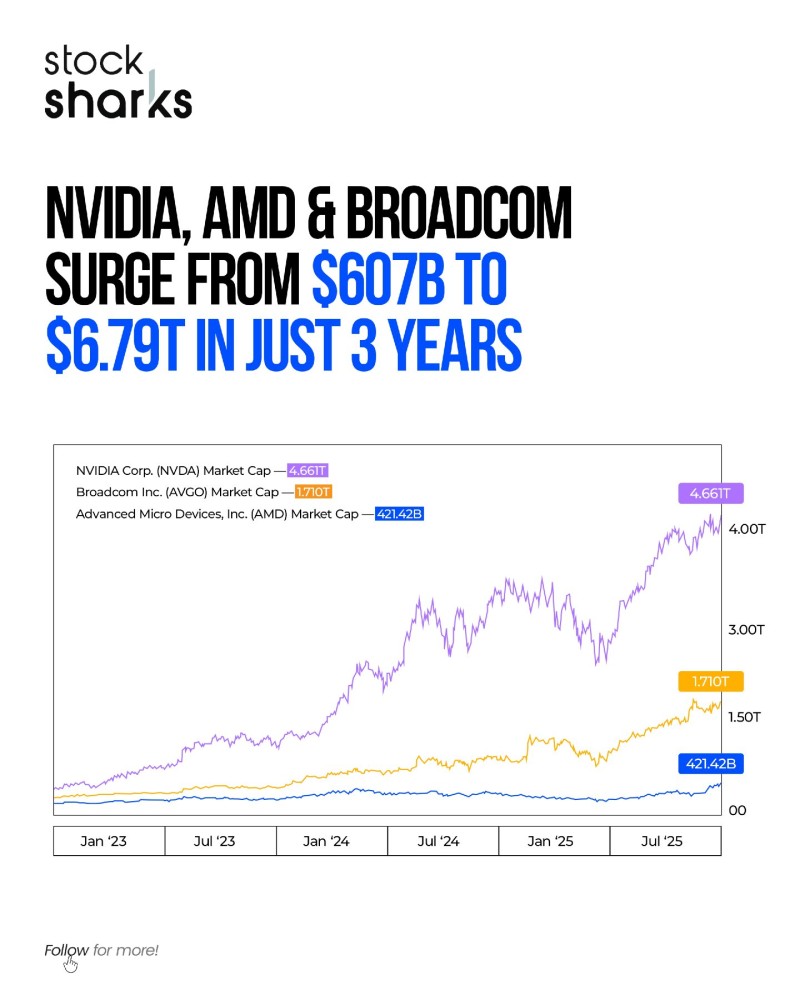

The global chip race has entered uncharted territory. What started as a quiet buildup in 2022 has exploded into a historic market expansion, with Nvidia, AMD, and Broadcom at the forefront. These three semiconductor powerhouses have collectively added over $6 trillion in market capitalization in just three years, reflecting how quickly AI has transformed not just technology, but the entire investment landscape.

Nvidia: The Undisputed AI Powerhouse

Nvidia (NVDA) dominates the landscape with a market cap of approximately $4.66 trillion. This explosive growth stems from its near-monopoly on AI GPUs, which power everything from large language models to cloud computing systems and generative AI platforms. According to Stock Sharks trader analysis, Nvidia's valuation began accelerating sharply in 2023 as global demand for data center hardware surged, driven by its advanced Hopper and Blackwell chip architectures.

These processors have become the backbone of infrastructure for Microsoft Azure, Amazon Web Services, and Google Cloud, essentially making Nvidia the beating heart of the AI economy.

Broadcom and AMD: Essential Players in the AI Ecosystem

Broadcom (AVGO), now valued at roughly $1.71 trillion, has carved out its own path through diversification. Beyond networking chips, its acquisition of VMware and leadership in custom silicon solutions have expanded its reach across enterprise computing and data transmission systems. The company's steady growth reflects its ability to serve multiple segments of the AI infrastructure market.

AMD, with a market cap of $421 billion, stands as Nvidia's primary challenger in the GPU space. Its MI300 accelerators and expanding partnerships with hyperscale data centers have positioned AMD as a credible alternative for AI workloads. While Nvidia maintains the performance edge, AMD's combination of competitive pricing and flexible software ecosystems continues to attract cloud providers and research institutions looking for options beyond a single supplier.

Reading the Chart: A Wealth Explosion in Real Time

The visualization captures one of the most powerful value creation events in modern market history:

- Nvidia's trajectory (purple line): An exponential surge beginning in early 2023, perfectly timed with the generative AI boom

- Broadcom's path (orange line): Consistent, sustained growth fueled by reliable demand in connectivity and specialized chips

- AMD's climb (blue line): Measured but steady progress, rising alongside broader data center adoption

The numbers tell a striking story: from $607 billion to $6.79 trillion in combined market value, investor capital has flooded into a small group of AI-focused semiconductor leaders, creating a concentration of wealth rarely seen outside of oil booms or dot-com peaks.

Peter Smith

Peter Smith

Peter Smith

Peter Smith