NIO is capturing trader attention as the electric vehicle stock builds momentum heading into next week's delivery announcement. The Chinese EV maker has seen renewed buying interest, with some previously bearish traders now turning bullish on the stock's prospects. Technical patterns suggest the shares could push toward the critical $8 resistance zone, making this a pivotal moment for the company's near-term trajectory.

Technical Setup Points to Potential Breakout

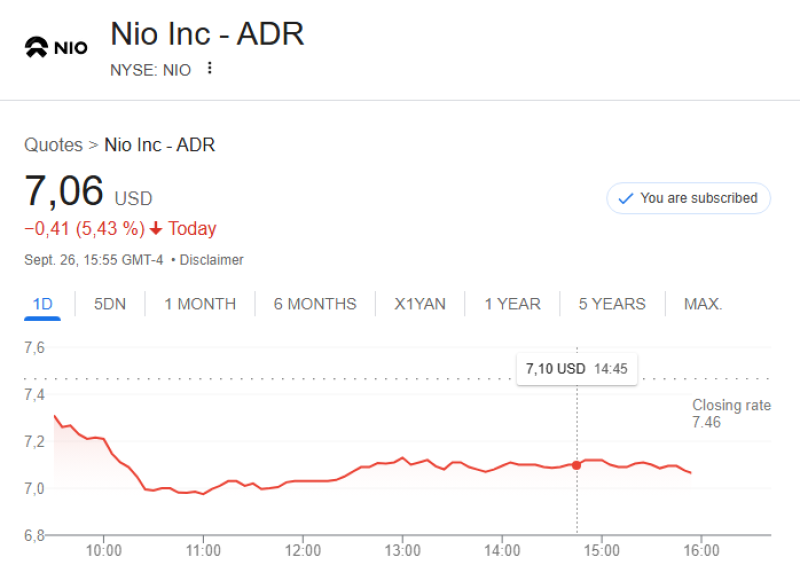

The stock has been building a solid foundation around the $7 support level, which has served as a reliable launching pad for buyers. Recent price action shows a series of higher lows forming, indicating that momentum is gradually shifting back in favor of the bulls. The key resistance zone sits between $7.80 and $8, representing the next major hurdle that could unlock significant upside if broken. Trading volume has notably increased during recent upward moves, suggesting both retail traders and potentially institutional investors are accumulating positions.

Delivery Numbers Could Be the Catalyst

The upcoming September delivery report has become a focal point for investors betting on NIO's recovery. Market participants are expecting stronger numbers compared to recent months, which would provide much-needed reassurance following a challenging summer period. Beyond just the delivery figures themselves, traders are closely watching for any forward-looking guidance regarding fourth-quarter deliveries, production efficiency improvements, or progress on overseas expansion plans. Positive signals on any of these fronts could provide additional fuel for a sustained rally.

Market Environment Presents Mixed Signals

NIO's recent strength comes at an interesting time for the broader EV sector. While Tesla and other competitors continue to face margin pressures, Chinese government support for electric vehicles remains robust, creating a supportive backdrop for domestic players like NIO. However, broader macroeconomic headwinds including rising U.S. Treasury yields, dollar strength, and concerns about slowing global growth could limit the stock's momentum. As a high-beta name, NIO remains particularly sensitive to shifts in overall market risk appetite.

Key Levels to Watch

If NIO manages to break cleanly above the $8 level, technical analysts see potential targets in the $8.50 to $9 range, particularly if the delivery numbers and guidance exceed current expectations. On the downside, failure to maintain the current momentum could see shares retreat toward the $7.20 support level or potentially lower if broader macro pressures intensify.

The coming week represents a crucial inflection point for NIO, with delivery data and management guidance likely to determine the stock's direction heading into the fourth quarter. The battle at the $8 resistance zone will be telling, as its outcome could establish the tone for the stock's performance in the months ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis