NIO stock (NYSE: NIO) surged over 6.49% after support from China's Huijin fund and a milestone of 300,000 SUV deliveries boosted investor confidence.

NIO Stock Rises After Significant Setback in 2024

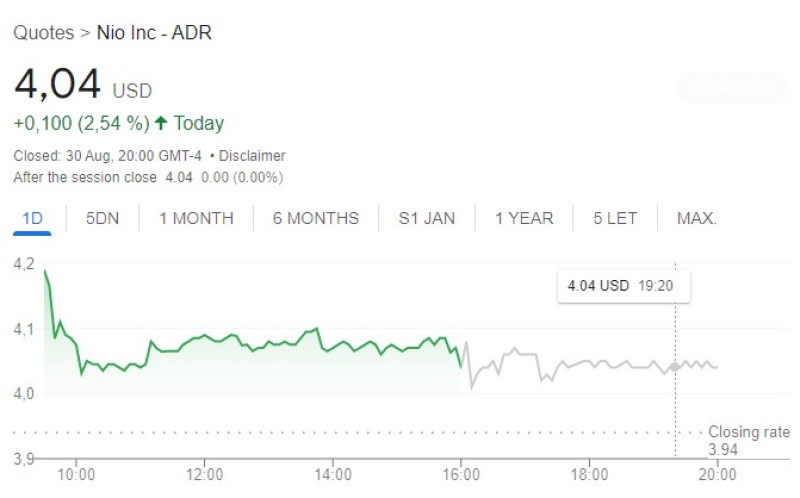

NIO shares, which had plummeted by more than 50% since the beginning of 2024, have recently shown signs of recovery. On August 29, NIO stock experienced a notable 6.49% increase, closing at $3.94. This momentum carried into pre-market trading, where NIO shares gained another 6.60%, pushing the price above the $4 threshold—a level not seen for most of the previous month.

A key factor in this surge was the heavy buying activity from China’s sovereign fund, Huijin, on August 30. This fund acts as an instrument for China’s central government to inject economic stimulus into selected companies, particularly those listed as American Depositary Receipts (ADRs). The aim is to stabilize Chinese stocks following a four-month decline. Although the exact amount invested by the Huijin fund remains undisclosed, the marked increase in NIO’s stock price suggests a significant influx of capital.

NIO Stock Boosted by Milestone Deliveries

Another catalyst for the surge in NIO stock was the announcement during the Chengdu Auto Show on August 30. Nio reported that its 6-Series SUVs, which include popular models like the ES6 and EC6, had surpassed 300,000 deliveries—a major milestone for the electric vehicle (EV) manufacturer. This achievement highlights Nio’s growing market presence and the increasing demand for its EVs.

Nio also unveiled ambitious plans to expand its charging infrastructure, targeting full coverage across 183 counties in Sichuan and 74 in Tibet by June 2025. Currently, Nio operates 953 charging piles and 93 battery swap stations in Sichuan. This expansion is expected to further bolster the company’s market position and support the continued rise in NIO stock.

In addition to infrastructure expansion, recent modifications to Nio’s Battery-as-a-Service (BaaS) policy have played a crucial role in boosting vehicle deliveries. By lowering battery rental fees, Nio has seen a significant uptick in demand, with monthly delivery averages now exceeding 20,000 units. This increase in deliveries is a positive sign for Nio’s future performance and contributes to the growing confidence in NIO stock.

Conclusion

Given the recent developments, investors are increasingly optimistic about Nio’s prospects. The support from China’s Huijin fund and the milestone of 300,000 SUV deliveries are key indicators that Nio is regaining its footing. As Nio continues to expand its infrastructure and adapt its policies to market demands, the potential for a sustained turnaround in NIO stock becomes more likely. Investors will be closely watching how these factors influence the stock’s performance in the coming months.

Usman Salis

Usman Salis

Usman Salis

Usman Salis