Not every resistance level you see is real. Sometimes what appears as heavy selling pressure is just smoke and mirrors. Large sell orders keep popping up and vanishing before anyone can actually trade into them, creating fake resistance that could be setting a trap for short sellers.

What the Data Shows

Trader Pax recently flagged questionable activity in NIO's order book that suggests someone's playing games.

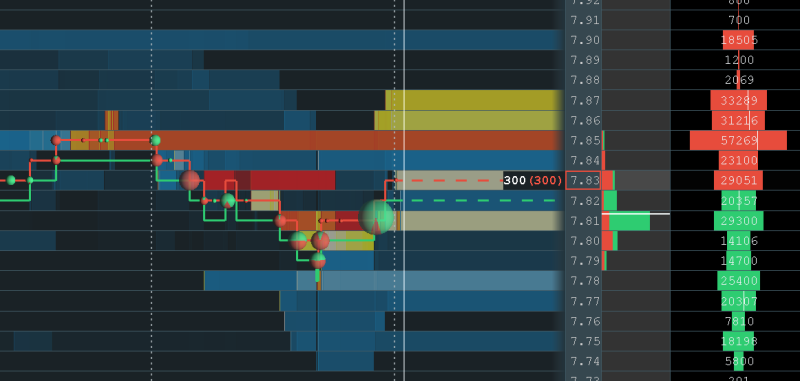

The heatmap reveals a suspicious pattern. Massive sell walls — we're talking 30,000 to 50,000 shares — keep appearing between $7.83 and $7.85, right above where the stock's trading. But here's the kicker: when price moves toward those levels, the orders disappear. If someone genuinely wanted to sell or push the stock down, they'd place orders below the current price. Instead, these walls are stacked above, making it look like NIO can't break higher. That's textbook spoofing designed to bait shorts into what might be a very uncomfortable position.

Why This Matters

First, don't trust that $7.80–$7.85 ceiling. It's probably not real resistance. Second, the actual liquidity — where people might legitimately want to sell — looks more like $10. And third, anyone shorting based on these fake walls could get squeezed hard if the stock suddenly pushes through.

From a technical standpoint, NIO's consolidating around $7.80. A break above $8 with decent volume could spark momentum, especially since there's not much genuine selling pressure below. On the fundamental side, NIO operates in a brutal EV market, but any positive catalyst — stronger delivery numbers or Chinese policy support — could combine with this order book setup to fuel a sharp move higher.

Peter Smith

Peter Smith

Peter Smith

Peter Smith