NIO traders might be catching a break. After weeks of choppy price action and what looks like a deliberate shakeout, the stock has found its footing and appears ready to move higher.

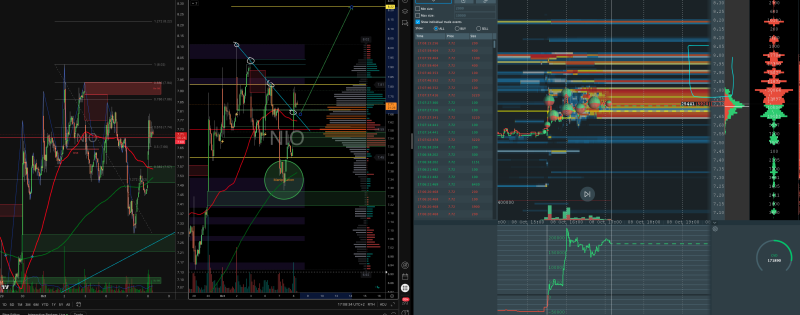

Chart Breakdown

A recent market update from Pax pointed out that the flush cleared out weak positions, creating space for bulls to target $8.20. The chart backs this up, showing solid support around $7.40, a reset in momentum, and fresh buying pressure building underneath.

The key support zone sits between $7.40 and $7.45, right where the stock bounced after the manipulation-style dip. That shakeout did its job, forcing out overleveraged longs and resetting the structure. Now there's less resistance overhead, which gives bulls more room to work with. Immediate resistance shows up around $7.75 to $7.80, reinforced by the 0.786 Fibonacci level at $7.86 and heavier volume clusters in that range. If buyers can push through that zone, the next logical target is $8.20 to $8.22, marked on the chart as the breakout objective.

Order flow data shows thick liquidity sitting right in that $7.70 to $7.80 range, making it the key battleground. Below $7.40, there was strong buy-side absorption that kept the stock from falling further. The cumulative volume delta is ticking up, showing that buyers are stepping in with more conviction. Meanwhile, the RSI cooled off after running hot during the last rally, and now it's sitting in neutral territory with room to climb. Shorter-term moving averages are starting to curl upward, lining up with the bullish setup.

Why This Setup Matters

A few things are working in NIO's favor right now. The manipulation flush wiped out weak hands and stabilized the price structure, which is exactly what you want to see before a move higher. There's clear liquidity above current levels, giving bulls a defined path forward. Momentum indicators have reset, and buying interest is picking up again. On top of that, there's renewed attention on Chinese EV stocks, with policy support potentially adding some fundamental lift.

That said, this isn't a sure thing. If NIO holds above $7.40 and breaks cleanly through $7.80, the door to $8.20 looks open. But if momentum stalls, there's a real chance we see another test of $7.20 to $7.25. The key is whether bulls can push through that liquidity wall in the $7.70s without giving up too much ground.

Usman Salis

Usman Salis

Usman Salis

Usman Salis