NIO has caught traders' attention following unusual order book behavior that suggests potential spoofing tactics. Heavy sell walls keep appearing and disappearing, pushing the stock lower as investors watch the $6 support zone closely.

Suspicious Order Flow Detected

Trader Pax recently pointed out that NIO's order book displays unusually large sell orders that vanish before they can be filled. This pattern, called spoofing, creates artificial downward pressure to manipulate short-term sentiment without actual selling intent. While regulators try to catch this behavior, it's tough to spot in real time, leaving retail traders at a disadvantage.

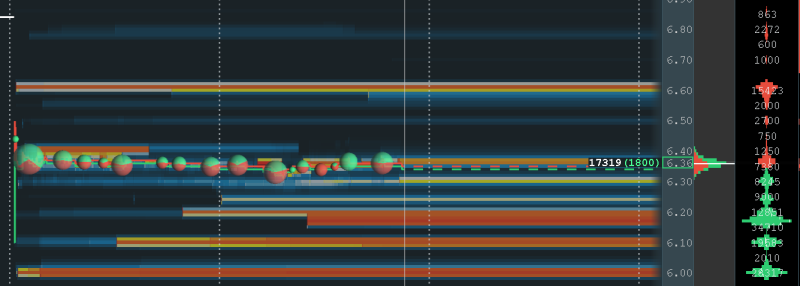

The heatmap reveals where the action is concentrated: heavy sell orders are stacked between $6.40 and $6.60, creating resistance that caps upward movement. Meanwhile, strong buying interest sits near $6.00–$6.20, marking this as a potential bounce zone. Right now, the price is being steered toward $6 by these phantom sell walls, while buyers try to hold the line at this psychological support level.

Market Context and Challenges

NIO's technical struggles come alongside some real fundamental pressures. Competition in China's EV market has intensified, with Tesla and BYD slashing prices aggressively. Investors remain concerned about NIO's path to profitability and its cash burn rate. Add to that the broader weakness in Chinese stocks due to macro and geopolitical uncertainties, and you've got a challenging environment. Still, speculative traders are circling these lows, hunting for quick opportunities.

What's Next for NIO

The $6 level is the line in the sand. If the spoofing fades and real buyers step in here, NIO could see a short-term bounce. But if this support crumbles, the stock could slide further with little to stop it until the mid-$5 range. For anyone holding or watching NIO, this moment underscores why risk management matters, especially in volatile stocks like this. Whether $6 holds or breaks will tell us if genuine demand exists or if the manipulation-driven pressure wins out.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir