BlackRock just made a move that's got everyone talking. The investment giant quietly bumped up its position in Nio Inc. (NIO) by 12% last quarter, and that's not the kind of thing that happens by accident. When you're managing nearly $10 trillion in assets, every move is calculated – and this one sends a pretty clear message about where they think the EV space is headed.

The timing couldn't be more interesting either. While most investors are still on the fence about Chinese stocks, BlackRock is apparently seeing something the rest of us might be missing.

Why Smart Money is Betting on NIO Price Recovery

Here's the thing about institutional investors like BlackRock – they don't chase trends, they create them. This 12% bump isn't just numbers on a spreadsheet; it's a statement. They're essentially saying that despite all the noise about trade tensions and EV competition, NIO's got the goods to deliver long-term returns.

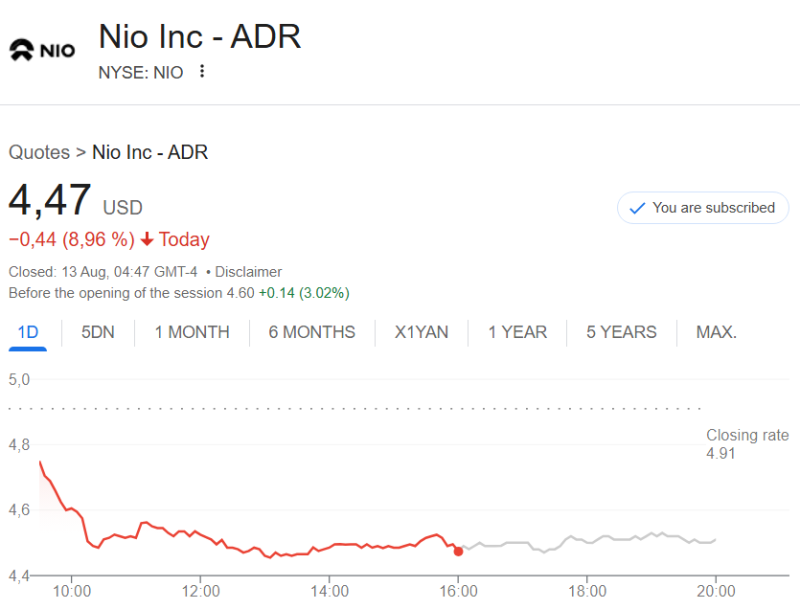

The market's starting to take notice too. NIO's price action has been picking up steam since the news broke, with traders interpreting this as a major vote of confidence. And let's be honest – when BlackRock moves, retail investors usually follow. It's like watching the cool kids pick their lunch table, and suddenly everyone wants to sit there.

What Makes NIO Worth BlackRock's Attention

So what's BlackRock seeing that has them loading up on more NIO shares? Probably a few things. First, Nio isn't just another EV company trying to copy Tesla's homework. They've got their own playbook with battery swapping technology that actually makes sense in dense urban markets like China.

Plus, they're not just thinking locally anymore. Nio's been making moves in Europe and eyeing other international markets. That's exactly the kind of global expansion story that gets institutional investors excited, especially when it comes with solid execution rather than just flashy press releases.

The competition angle is real though. Tesla's still the big dog, BYD is breathing down everyone's neck in China, and XPeng isn't backing down either. But maybe that's exactly why BlackRock's move is so telling – they're betting that NIO can hold its own in this heavyweight fight, and potentially come out swinging even harder.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah