Chinese electric vehicle manufacturer NIO saw its Hong Kong-listed shares gain significant ground during Monday's trading session, reflecting renewed investor interest in the EV sector amid a broader market rally. The stock's performance comes at a time when Chinese growth stocks are experiencing increased attention from both institutional and retail investors.

NIO Rallies in Hong Kong

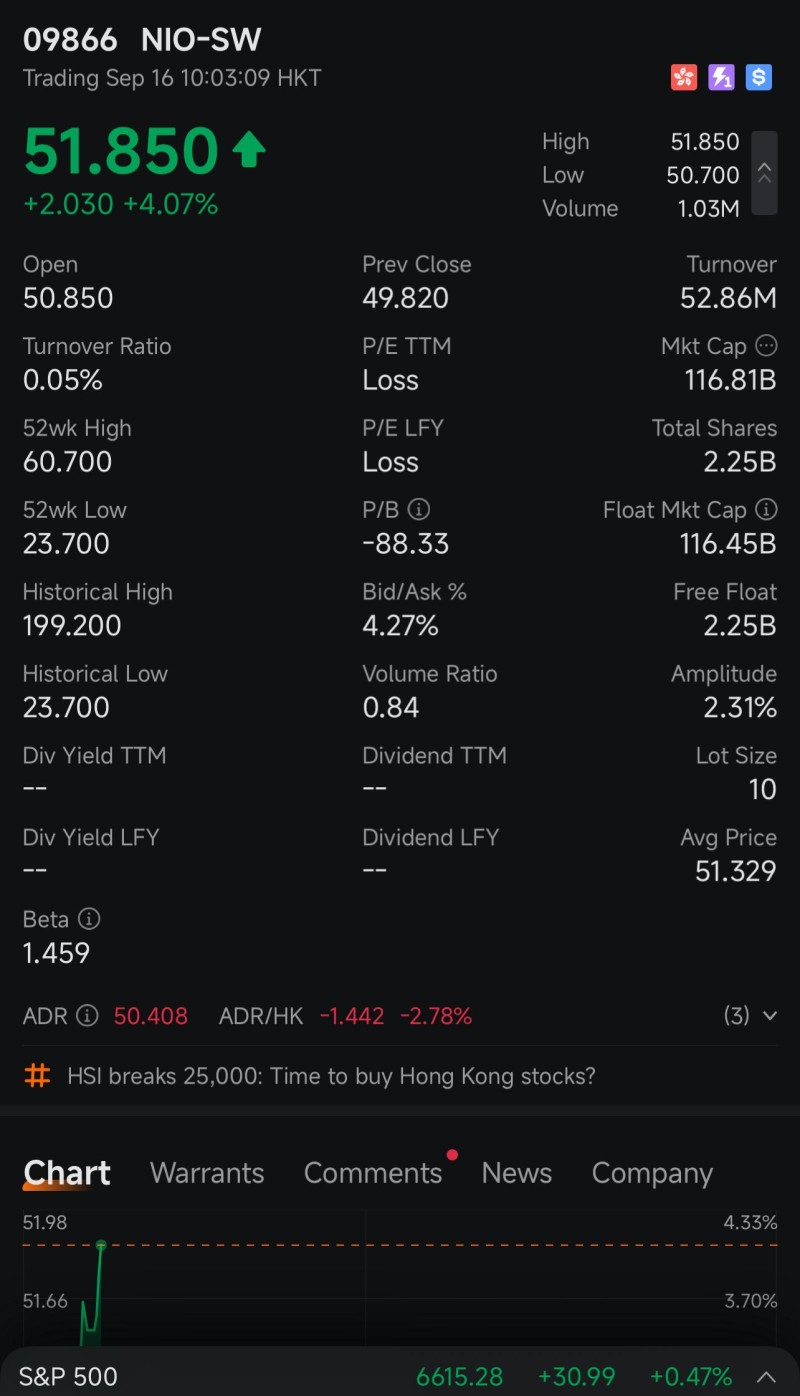

NIO (09866.HK) jumped 4.07% to HK$51.85 in Monday morning trade, extending its rebound in Hong Kong markets. The move coincides with a rally across the Hang Seng Index, which broke above 25,000, encouraging risk appetite in Chinese growth names. According to trader Steve-DOGE-NIO, the price action shows that investor appetite for NIO remains strong despite ongoing financial challenges.

The stock's performance suggests that market participants are positioning for potential upside as broader sentiment toward Chinese tech and EV companies improves.

Chart Analysis: NIO Gains Momentum

The trading snapshot reveals several key technical developments. Shares opened at HK$50.85, above the previous close of HK$49.82, and quickly climbed to the day's high of HK$51.85. The push past HK$51 suggests momentum buyers are active, with near-term resistance at HK$52–52.50, while initial support lies at HK$50.70, today's intraday low. Turnover reached HK$52.86M on 1.03M shares traded, underscoring steady participation despite a turnover ratio of just 0.05%.

Why NIO Stock Is Rising

Several factors are driving the stock's latest move higher. The broader Hong Kong rally has improved sentiment as the Hang Seng climbed above the 25,000 threshold. NIO remains well below its 52-week high of HK$60.70, attracting bargain hunters looking for value plays. Optimism for Chinese EV demand continues to fuel sector gains, with NIO often trading as a bellwether for the industry. Interestingly, U.S.-listed NIO ADRs slipped to $50.41 (-2.78%), reflecting different sentiment across markets.

Key Metrics to Watch

Important financial metrics include a market cap of HK$116.81B and 2.25B shares in free float. The stock shows high volatility with a beta of 1.459, highlighting NIO's sensitivity to market swings. Both trailing and forward P/E remain negative, keeping NIO dependent on future growth prospects rather than current profitability.

Peter Smith

Peter Smith

Peter Smith

Peter Smith