Beating the market sounds great in theory, but it's harder than most people think. It shows the classic emotional rollercoaster that retail traders ride over and over: buying after a rally, panicking when things drop, and only feeling confident again after missing the recovery.

The Emotional Trap

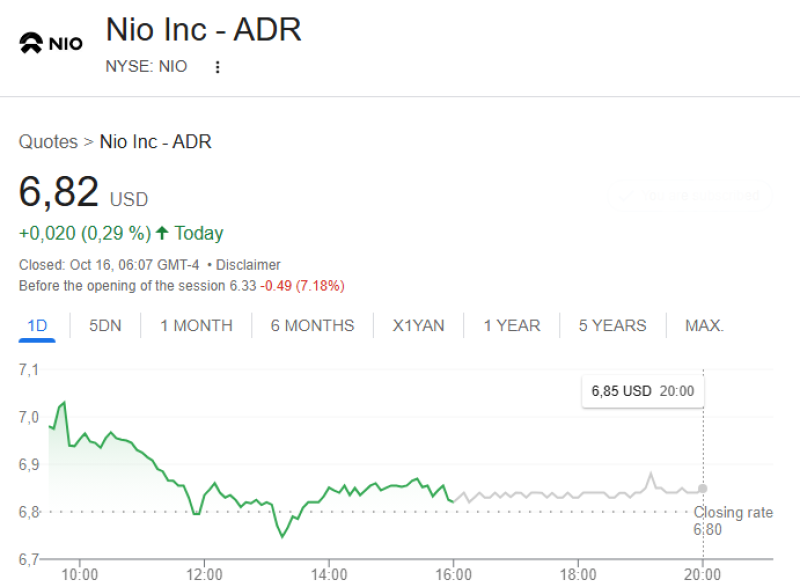

A recent chart shared by Pax, captioned "$NIO WELCOME TO (I TOLD YOU SO!)," captures exactly why trying to time your trades often ends badly. The psychology behind failed market timing shows up in three predictable stages. First, investors pile in after prices have already climbed, thinking they've figured out the game. Then comes the crash, and fear takes over. Panic selling at the bottom turns paper losses into real ones. Finally, when the stock bounces back, confidence returns, but now they're forced to buy in at higher prices again—the classic "I told you so" moment. NIO stock has been a perfect example of this lately. Plenty of retail investors bailed during the dips, only to watch it climb back up without them.

What's Going On with NIO

NIO's wild price swings aren't happening in a vacuum. The EV market is brutal right now, with Tesla, BYD, and a bunch of other Chinese companies fighting for the same customers. Add in worries about China's economy and shifting interest rates globally, and you've got a recipe for volatility. Speculative money flows in and out of NIO faster than it does with old-school car companies, which makes the ride even bumpier. That said, NIO still has solid brand recognition and keeps ramping up production, which matters if you're thinking long-term and can handle the swings.

Here's the truth: timing the market almost never works. Reacting emotionally, whether that's buying into hype or selling out of fear, usually leaves you worse off than just sticking to a steady plan. The pattern repeats itself because emotions don't change, even when the stock does.

NIO's recent trading is just another reminder that markets move in cycles, but our emotions make the losses worse. That "I told you so" phase on the chart? It's the frustration of missing out because you couldn't sit still. For most retail investors, the smarter play is focusing on the basics and holding through the chaos instead of trying to catch every swing.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets