After months of sideways trading and doubt around Chinese EV manufacturers, NIO is showing signs of a serious comeback. Fresh data and chart patterns suggest investor sentiment is shifting, with the ONVO L90 production boost potentially marking the start of the company's most profitable chapter to date.

NIO Ramps Up ONVO L90 Production by 50%

Trader Jaime WorldCitizen recently highlighted that NIO has expanded ONVO L90 production capacity by half, signaling a major operational push as the year winds down. If projections hold, Q4 could be the strongest quarter in NIO's history, with deliveries expected to hit over 40,000 in October, 50,000 in November, and 60,000 in December.

That kind of pace could finally push the company into sustained profitability. The ONVO L90, a new SUV in NIO's premium range, has quickly become central to the company's growth plan.

Strong home market demand, supportive government policies, and better battery supply have given NIO the tools to compete more aggressively with heavyweights like BYD and Tesla.

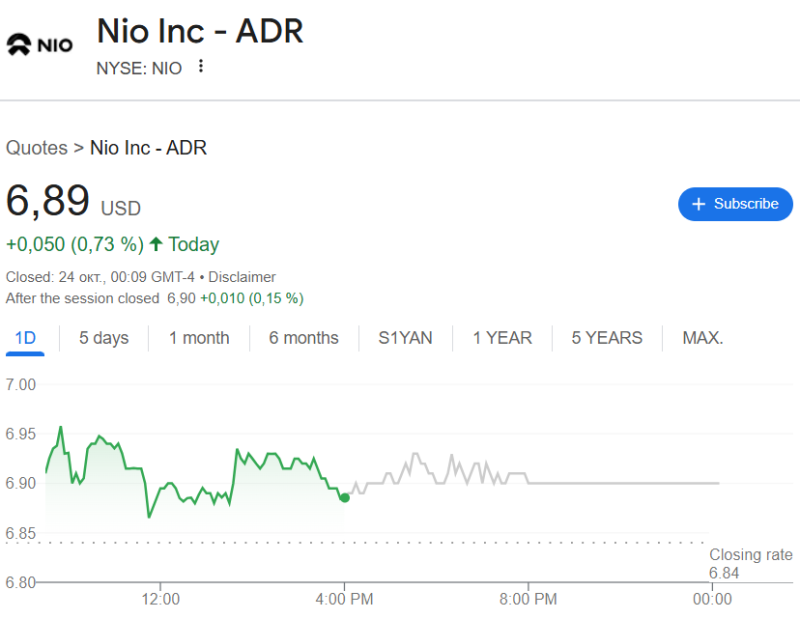

Chart Analysis: Uptrend Building Momentum

The chart shows NIO stock climbing out of a long consolidation near $6–$7 and gaining upward momentum. Price is now testing the $8.50–$9.00 resistance zone, where previous rallies lost steam earlier this year. Volume shows renewed interest, with accumulation matching the positive production news. The structure hints at an ascending channel forming, and if momentum holds, the next logical target sits around $10.00, a level that previously acted as resistance in 2024. Meanwhile, $7.00 now looks like solid support, and as long as that holds, the medium-term technical picture stays bullish.

Path Toward Profitability

NIO's capacity expansion is part of a broader strategy focused on domestic manufacturing efficiency and supply chain optimization. While China's EV market remains fiercely competitive, the company's recent performance, major partnerships, and government backing show strategic resilience. If NIO delivers over 150,000 vehicles in Q4, it won't just be a production win but a financial turning point, potentially marking its first fully profitable period since 2021.

Usman Salis

Usman Salis

Usman Salis

Usman Salis