The electric vehicle industry is facing a critical juncture, and NIO Inc. (NYSE: NIO) finds itself at center stage. CEO William Li has reinforced his commitment to achieving profitability in Q4, urging employees to intensify their focus on this crucial milestone. His message has sparked renewed conversation among investors about whether the company can finally turn the corner after navigating intense price wars and economic headwinds in China.

Leadership Doubles Down on Profitability

Li made it clear during an internal meeting that hitting the Q4 profit target isn't optional—it's essential. According to NIO Admirer, who first shared details of the meeting, the CEO's tone reflected both urgency and determination. This comes after several tough quarters marked by fierce competition from BYD, Xiaomi, and Tesla, all battling for market share in China's crowded EV space.

The push for profitability isn't just about numbers. It's about proving that NIO can streamline operations, refine its product lineup, and cut costs without sacrificing growth potential.

For investors who've watched the company burn through cash while scaling up, this message carries weight—it's both a rallying cry for employees and a promise to shareholders that management takes accountability seriously.

Technical Picture Shows Stability

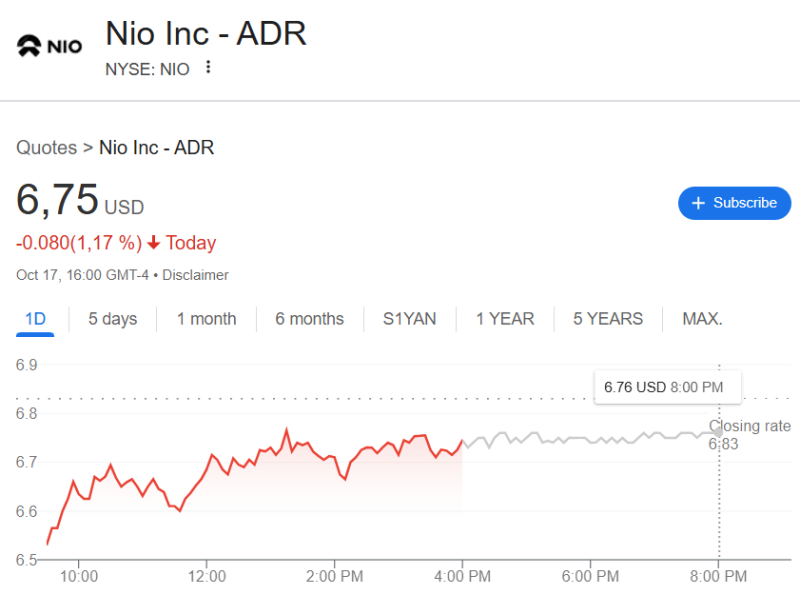

Looking at the chart, NIO shares have been holding steady around the $4.50–$4.70 range throughout Q3 2025. This zone has acted as a reliable floor, with buyers consistently stepping in when prices dip. Volume patterns suggest gradual accumulation rather than panic selling, which is encouraging for anyone watching the stock's next move. The current phase looks like base-building—a consolidation that could set the stage for upside if sentiment shifts positively. Key resistance sits around $6.00 and $7.00, levels that would signal renewed confidence if breached. Early momentum indicators like RSI and MACD are starting to tick upward, hinting at potential reversal after months of downward pressure.

Strategy Focused on Efficiency and Growth

NIO isn't just betting on profitability through cost-cutting alone. The company is doubling down on its battery-as-a-service model, tightening supply chains, and preparing for deeper expansion into Europe through local partnerships. On the product side, flagship models like the ET9 luxury sedan and ES6 SUV are leading the charge, packed with advanced autonomous features and better energy efficiency. Management has also pulled back from less profitable experiments to focus resources where they matter most. It's a shift from the "grow at all costs" mentality toward disciplined, sustainable growth—exactly what Li's profitability pledge demands.

Investor Confidence Slowly Returning

There's a cautious optimism building around NIO following Li's remarks. Short interest has declined, and institutional investors seem to be quietly adding positions, betting on a potential turnaround heading into Q4. For many, this quarter isn't just another earnings report—it's a credibility test. If NIO delivers on its promise, it could mark the transition from a high-growth startup bleeding cash to a mature company generating profits. That shift would fundamentally change how the market values the stock.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov