After years of decline, NIO may finally be entering the disbelief stage of the classic market psychology cycle - a phase that often precedes strong reversals. This positioning could mark a turning point for the Chinese electric vehicle maker, as investor sentiment reaches the point where most have given up hope just as fundamentals begin stabilizing.

Market Psychology at Work

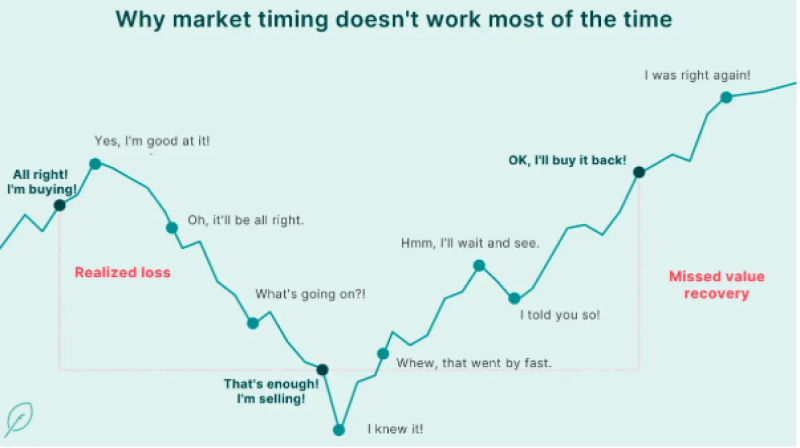

Market timing rarely works as intended, and the chart of investor emotions proves it. Investors tend to buy at euphoric highs and panic sell at lows, missing the true recovery. Trader Pax points out that after a four-year downtrend, many NIO traders are mentally exhausted. This is precisely how market psychology functions: the disbelief stage convinces most participants that every green candle is just another fake rally destined to fail.

The psychology chart aligns perfectly with NIO's current situation. Realized losses occurred during panic selling at the bottom, value recovery was missed on the initial rebound, and disbelief now dominates investor sentiment. While retail investors sold in fear around the $6–7 range, institutions quietly built positions, recognizing the potential that exhausted retail traders couldn't see.

NIO's Current Position

With the bear trap likely behind it, NIO shows early signs of a potential recovery. Reversal signals are emerging as the stock stabilizes and begins to attract attention from those who previously wrote it off. The psychological target sits at $20, a level that becomes achievable if disbelief gradually gives way to acceptance and eventually FOMO among retail investors.

Why It Matters

Cycles like this repeat across markets. Disbelief is a powerful stage because it blinds traders until the recovery is well underway. That makes the current setup for NIO particularly significant, as the foundation for a broader uptrend may already be forming beneath the surface while most investors remain skeptical.

What's Next

If NIO can sustain momentum above recent levels, it may transition from disbelief to acceptance, attracting retail buyers once again. The next major phase could be a rally toward the $20 mark, fueled by returning confidence and FOMO. Investors who wait too long risk realizing too late that the recovery has already begun, repeating the same psychological mistakes that caused them to miss the bottom.

Usman Salis

Usman Salis

Usman Salis

Usman Salis