NIO is back on traders’ radar as the stock hovers near a familiar support level that previously sparked a swift rally. After dipping to $4.44 last week and quickly gapping higher at the open, the EV stock is now offering what some are calling a second chance for those who missed the move. Market participants are closely watching whether history will repeat itself—and if NIO’s next bounce could be just as fast.

NIO Price Finds Stability Near Key Support

The price of NIO is currently consolidating just above the crucial $4.44 support level, and traders are keeping a close eye on what could be another fast-moving setup. After several sessions of sideways movement—what many refer to as “chop”—NIO may now be offering a second opportunity to buy the dip before a potential rally.

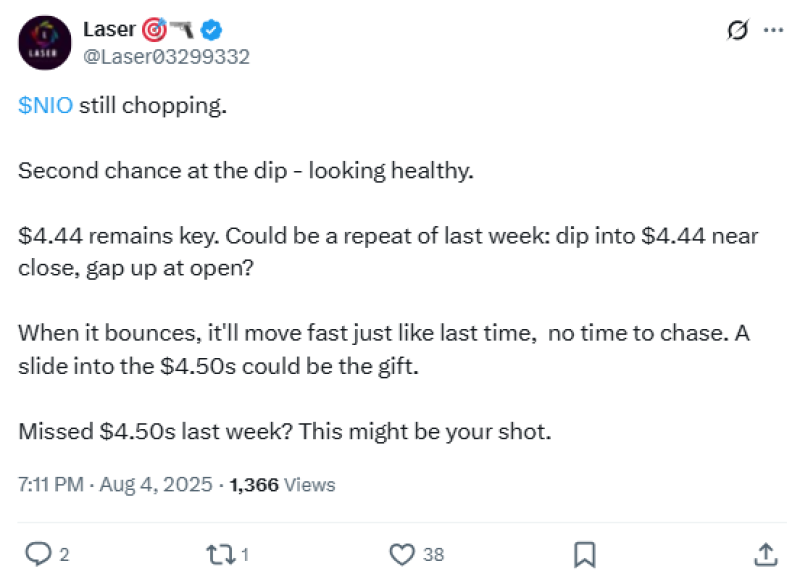

In a recent tweet, a trader summarized the sentiment:

This commentary reflects growing speculation that history might repeat itself, and a similar bounce could occur if $4.44 continues to hold.

NIO Price Could Mirror Last Week’s Rally

Last week, NIO dipped toward $4.44 late in the session and then gapped up on the next open, leaving many traders behind. The speed of that move was notable—and now, the current price action is showing early signs of that same pattern.

Analysts are suggesting that a slide into the $4.50s may once again be the entry window, but only briefly. As the tweet notes, the move tends to come quickly: “no time to chase.”

The $4.44 zone has proven to be a reliable springboard in the past, and a repeat move toward $4.62 could be on the cards if momentum returns.

NIO Price Levels to Watch

If the $4.44 level continues to act as support, traders are likely to focus on the $4.50–$4.60 resistance range, which marked last week’s post-bounce highs. A break and hold above this level could open the door to a broader rally or even shift short-term sentiment in favor of bulls.

Key levels to monitor:

- Support: $4.44

- Resistance: $4.50–$4.60

- Potential breakout zone: Above $4.62

The opportunity may not last long. Those who missed the move last time are watching closely for signs of confirmation—another quick rebound could materialize.

Usman Salis

Usman Salis

Usman Salis

Usman Salis