NIO (NYSE: NIO) caught traders' attention after unusual options activity surfaced in the final minutes of trading. Over $4.5 million in long-dated call contracts changed hands in less than ten minutes, prompting questions about whether institutional money is positioning for something bigger. The timing and size of these trades have market watchers wondering what might be coming next.

The Options Flow Breakdown

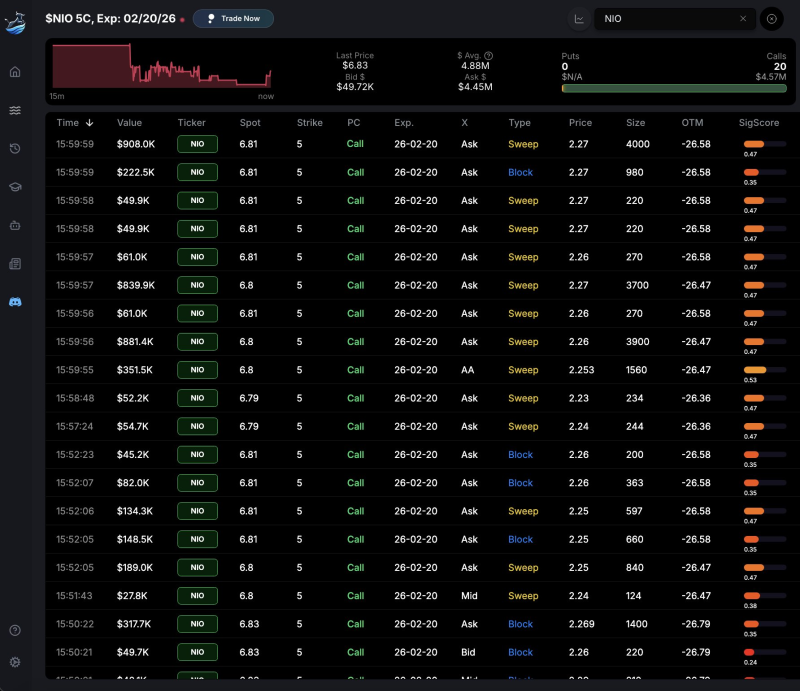

As noted by Bullflow.io, most of the action focused on February 20, 2026 $5 strike calls:

- Total invested: Roughly $4.57 million in call contracts

- Timing: All packed into the final 10 minutes before close

- Order types: Mostly sweeps and blocks, suggesting urgency

- Execution: Bought at the ask around $2.24–$2.27

- Stock price: NIO trading between $6.79–$6.83

- Scale: 20 large trades hitting the tape

These deep out-of-the-money calls point to either pure speculation or someone betting on a significant move higher over the next year and change.

What the Chart Shows

NIO is currently trading around $6.80, sitting in a consolidation zone after months of volatility. Support appears solid near $6.50, where buyers have shown up before. The next meaningful resistance sits between $7.20 and $7.50.

The stock's been grinding through a longer downtrend but seems to be finding its footing. Breaking above $7.50 with decent volume would line up nicely with what the options market is suggesting. The recent volume uptick alongside the options surge hints that someone might be accumulating shares quietly.

Why Traders Are Paying Attention

A few things are putting NIO back on radars. China's EV market keeps expanding despite fierce competition from Tesla and BYD. Government support through subsidies and incentives could provide a boost. NIO's been expanding its vehicle lineup and talking up delivery targets through 2026. And at under $7 a share, it's trading well below its previous highs, making it tempting for those willing to take a swing.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova