NIO is about to make history. The EV maker is weeks away from hitting one million cumulative deliveries - a milestone that proves its rapid rise from startup to serious contender. What makes this moment even more interesting? The charts are firing on all cylinders at exactly the same time. When fundamentals and technicals line up like this, things tend to get exciting.

The Road to One Million

As NIO Admirer recently pointed out, NIO's closing in fast on that seven-figure delivery number. This isn't just a vanity metric - it validates everything the company's been building. Their premium EVs, battery-swap stations, and expansion into sub-brands like Onvo and Firefly are all paying off. China's aggressive EV push has helped, sure, but NIO's carved out real space against giants like Tesla and BYD. That takes execution.

What the Charts Are Saying

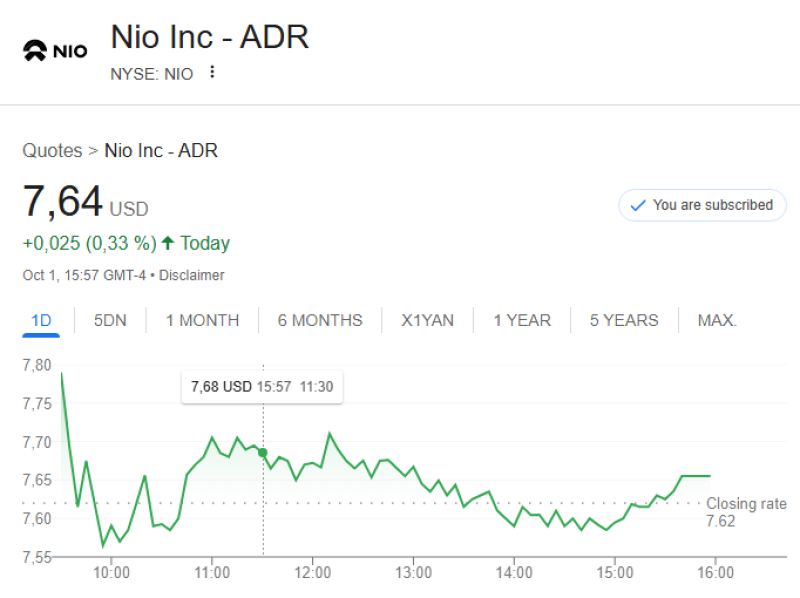

The technical picture shows NIO trading with cautious optimism. After bottoming near $5.25 earlier this year, the stock has been steadily recovering, now holding in the $7.50–$7.70 range. Today’s session closed at $7.64, reflecting a modest +0.33% gain.

The chart illustrates a market that’s consolidating rather than accelerating—volume remains moderate, suggesting accumulation is still underway. Key resistance lies around the $8.00 level, while immediate support can be found near $7.50. A sustained breakout above $8 could open the door for a stronger move, but for now, the trend signals steady progress rather than a parabolic surge.

Why This Matters Right Now

Three reasons this milestone changes the game:

- Brand credibility: One million deliveries puts NIO in elite company globally and proves they can scale production

- Market confidence: The technical setup shows institutions are accumulating, not just watching from the sidelines

- Growth runway: Battery-swap infrastructure and international expansion plans position NIO for the next phase, not just celebrating the last one

What's Next

NIO's delivery milestone isn't the end of the story - it's validation that the story's worth following. The fundamentals are proving out while the technicals are screaming strength. If the stock clears $8 with conviction, we could be looking at the start of something bigger. The company's done the hard part. Now comes the fun part.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah