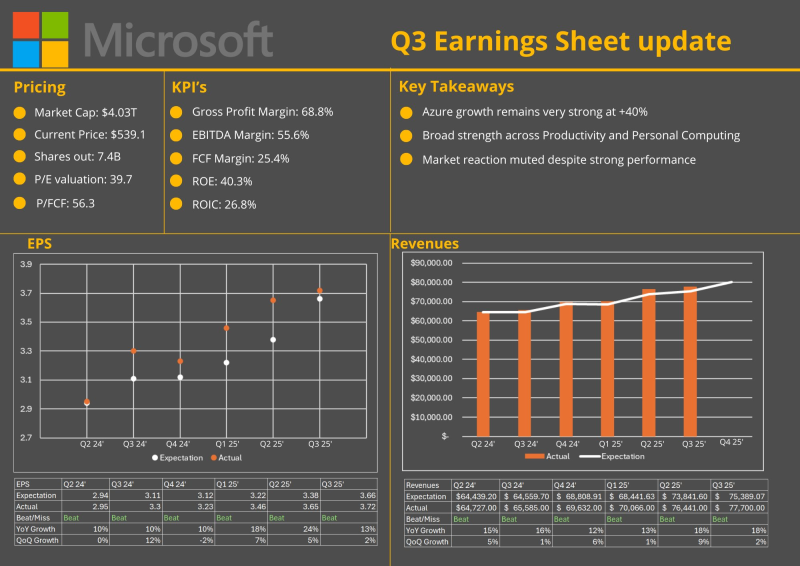

● Microsoft ($MSFT) delivered another solid quarter, beating both earnings and revenue forecasts as AI and cloud demand kept climbing. Still, the stock dropped 2% after hours — likely because investors have sky-high expectations after months of AI hype.

● Microsoft posted earnings per share of $3.72 (beating the $3.66 estimate) and revenue of $77.7 billion (topping the $75.4 billion forecast). Azure jumped 40% year-over-year, while total Cloud revenue grew 26%, showing Microsoft's strength in enterprise computing and AI infrastructure. The results also showed solid performance across Productivity and Personal Computing — proving this isn't just an AI story.

● Financially, Microsoft looks rock-solid. Gross margin hit 68.8%, EBITDA margin reached 55.6%, and ROE came in at 40.3%. The company's market cap now sits at $4.03 trillion. These numbers show strong efficiency and profitability, even with competition heating up from Google Cloud and AWS.

● But investors seem cautious. With Microsoft trading around 40x earnings, some analysts think the AI growth story is already baked into the price. Even a solid beat didn't move the needle much. That said, Microsoft's AI push — from Azure AI to Copilot in Office and GitHub — should drive long-term enterprise demand.

● Microsoft's cloud leadership, AI integration, and strong margins keep it among the best-positioned tech companies globally.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah