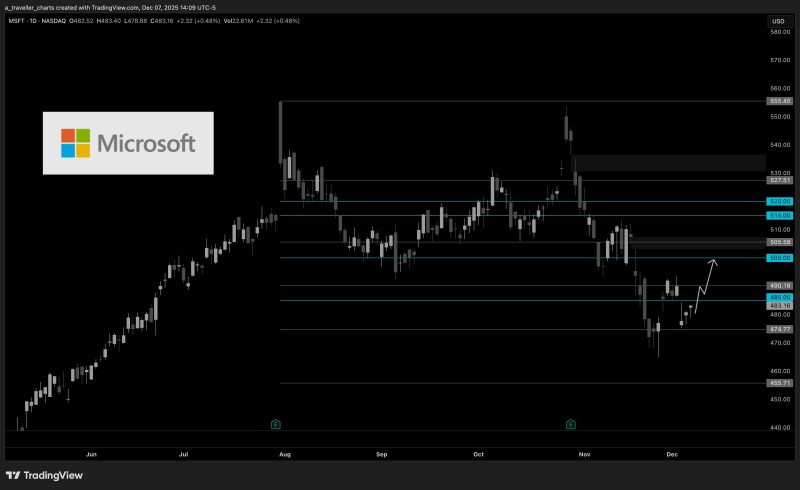

⬤ Microsoft's been stuck in a holding pattern lately, trading around $483 as it tries to build some upward momentum. The stock's currently moving within Wednesday's daily range, which has created a pretty clear technical picture for traders keeping tabs on it. Key resistance levels sit between $485 and $500, with noticeable liquidity zones that have influenced recent price action.

⬤ Getting above Wednesday's highs is the critical move here if Microsoft wants to make a real push toward $490. The chart shows the stock bouncing back from the $474-480 zone and putting in higher lows throughout the day. Back in November, shares got rejected around $515-520, so getting back to those levels means first reclaiming that $500 mark. On the technical side, you're looking at resistance at $485, $490, and $505, with heavier selling pressure waiting up near $527-555.

⬤ There's some concern about where Microsoft stands in the AI competition right now. The company seems to be trailing its rivals, and certain products just don't have the same buzz or traction as what competitors are putting out. Still, the technical setup looks decent enough. If things stay on track, MSFT could hit $500 within the next few weeks, combining solid chart patterns with the ongoing interest in major tech stocks.

⬤ This matters because Microsoft carries serious weight in both the tech sector and the broader market. How MSFT moves can shape the overall market mood, especially when AI themes are driving where money flows. If the stock breaks through these near-term resistance levels cleanly, it would signal renewed buying confidence and could lift the whole megacap tech space along with it.

Peter Smith

Peter Smith

Peter Smith

Peter Smith