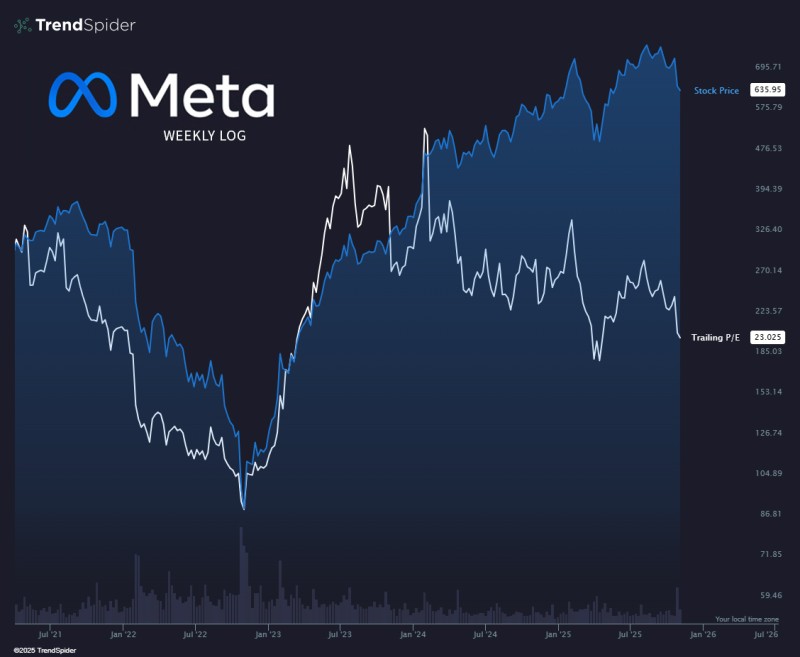

Meta Platforms is entering a phase that long-term investors rarely see: steady stock appreciation paired with a falling valuation multiple. The latest weekly chart shows Meta's share price climbing while its trailing P/E ratio declines toward multi-year lows — a combination that often emerges before major expansion cycles.

META's Price Climbs While Its Valuation Slips Lower

In a recent tweet, TrendSpider trader pointed to Meta as an example of a "diamond in the rough," highlighting a powerful divergence between price strength and decreasing valuation.

The chart shows META stock price in a strong uptrend from early 2023 through late 2025, while the trailing P/E ratio slopes downward to around 23. This suggests Meta's earnings have accelerated faster than the market has adjusted its valuation — a dynamic that often signals improving efficiency and potential undervaluation.

Chart Analysis: Strong Trend, Cooling Valuation

META bottomed in early 2023 and began forming higher highs and higher lows, with momentum strengthening throughout 2024 and 2025 toward the $635–$700 zone. While price climbed, the trailing P/E ratio fell from around 40 in 2023 to roughly 23 by late 2025, meaning investors are paying less for each dollar of earnings despite the stock trading near all-time highs. This unusual divergence often appears when earnings expand faster than expected and market sentiment remains cautious despite strengthening fundamentals.

What's Driving META's Strength?

Meta's AI-driven engines are delivering better ad efficiency, digital advertising demand has rebounded meaningfully since 2022, and aggressive share buybacks continue boosting EPS. More efficient spending in Reality Labs has also improved Meta's overall margin profile.

Usman Salis

Usman Salis

Usman Salis

Usman Salis