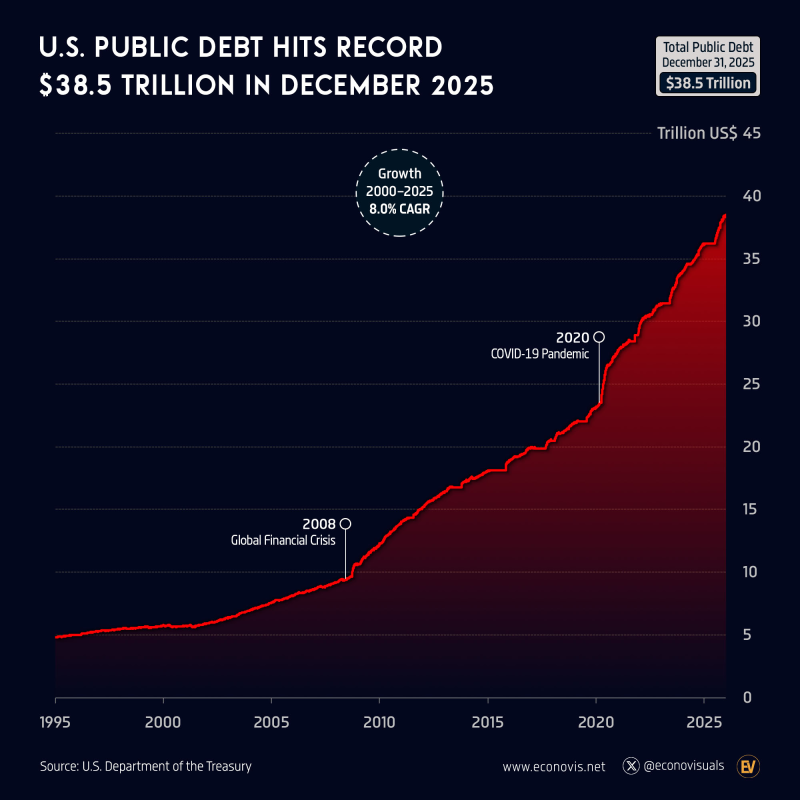

⬤ U.S. public debt just set a new record, closing 2025 at $38.51 trillion according to official data. Total debt jumped by $2.3 trillion over the year—a 6.3% annual increase. The numbers show how federal borrowing has steadily climbed since the late 1990s, with sharp spikes during the 2008 financial crisis and the 2020 COVID-19 pandemic. Financial markets continue watching these developments closely.

⬤ The long-term picture is striking. From 2000 through 2025, U.S. public debt grew at roughly 8.0% annually. The curve has gotten steeper as borrowing increased to fund government spending programs and economic rescue measures during crisis periods. The 2008 and 2020 events stand out as major inflection points that pushed debt levels significantly higher. This sustained expansion shapes the backdrop for global markets and economic policy decisions.

⬤ By December 31, 2025, total public debt sat just under the $40 trillion threshold—the highest on record. The $2+ trillion increase in 2025 alone shows fiscal expansion hasn't slowed down. The data reveals an almost uninterrupted upward climb over two decades, with no meaningful reversals. Market participants continue tracking these numbers as a key macro indicator.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah