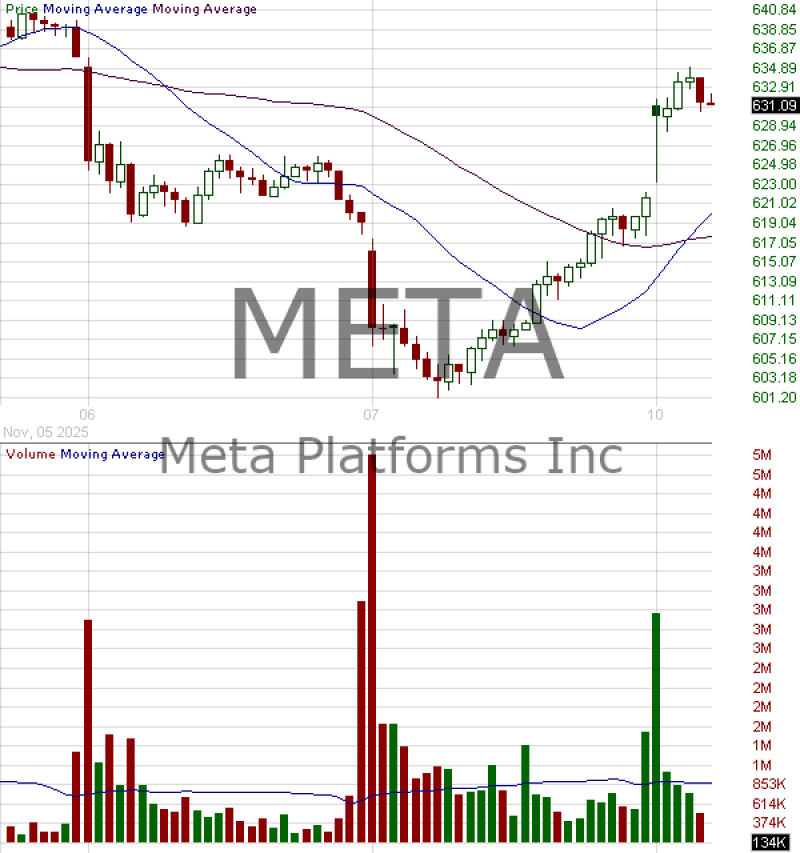

⬤ Meta appears to be confirming a solid base in the $620–$630 range, with technical signals pointing to a possible breakout ahead. The stock has bounced back from earlier weakness and is now trading around $631, sitting comfortably above its short-term moving averages. The chart shows improved stability near support, suggesting the selling pressure may be fading.

⬤ The upside targets are now set at $650 and $680. Recent price action backs this up—Meta is building higher lows while volume increases on green candles. The rebound from the lower end of the range shows buyers are stepping in with conviction, and the rising moving averages reflect stronger short-term trend alignment as the stock edges closer to breakout territory.

⬤ Strong green volume bars during the climb add weight to the bullish case, showing consistent demand rather than just a quick bounce. Reclaiming the $620–$630 zone marks a shift from sideways consolidation to momentum building, with the price tightening under resistance. If current market conditions hold, Meta could push higher from here.

⬤ For investors, holding this support range matters because it sets a clear risk level while keeping Meta aligned with the broader strength in AI-related tech stocks. A breakout toward $650–$680 would confirm bullish momentum and keep the rally intact. On the flip side, losing the $620–$630 base could bring short-term pressure back into play. For now, the technical setup leans bullish as long as support holds.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets