Explore the potential of Coca-Cola Company's (KO) stock amidst recent market trends and fundamental indicators.

Earnings Estimate Revisions

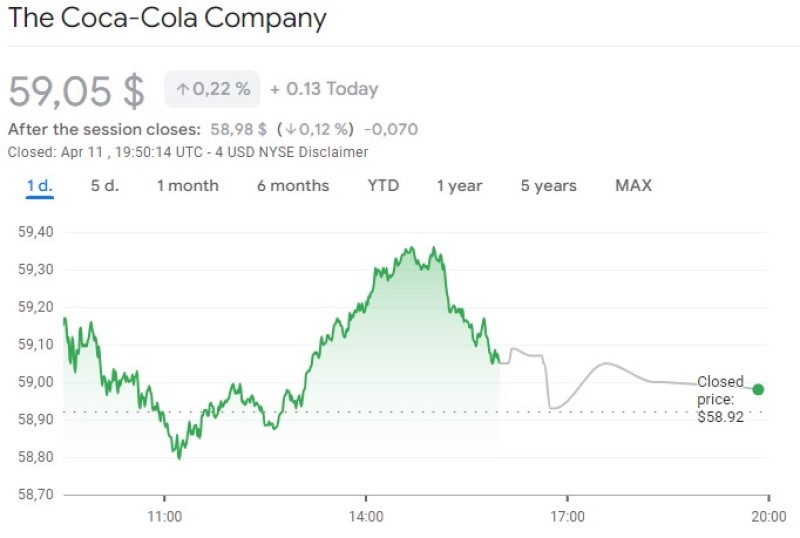

Coca-Cola (KO) has captured investor interest, featuring prominently on Zacks.com's list of the most searched stocks. With its recent performance under scrutiny, it's crucial to delve into the key factors shaping its trajectory.

Evaluating a company's earnings projection is paramount at Zacks. This metric forms the bedrock of our analysis, as it reflects the anticipated future stream of earnings, driving stock valuation. Currently, KO is projected to post earnings of $0.70 per share for the current quarter, with a year-over-year change of +2.9%. Despite this stability, the Zacks Consensus Estimate for the fiscal year remains unchanged at $2.81, indicating a year-over-year change of +4.5%.

Projected Revenue Growth

While earnings growth is pivotal, revenue expansion is equally vital for sustained financial health. Coke's consensus sales estimate for the current quarter indicates a slight decline of -0.2%, raising concerns. However, estimates for the next fiscal year show promise, with a projected growth of +4.9%, potentially buoying investor confidence.

Coke's last reported quarter showcased resilience, with revenues surging by +7.2% year-over-year, surpassing expectations. The company's consistent ability to exceed consensus EPS and revenue estimates over the past four quarters underscores its operational efficiency.

Assessing a stock's valuation is indispensable for informed investment decisions. While KO exhibits strong fundamentals, its valuation metrics, evaluated through the Zacks Value Style Score, suggest that it is trading at a premium to its peers, meriting cautious consideration.

Conclusion

Amidst the market buzz surrounding the Coca-Cola Company, a nuanced evaluation of its performance is imperative. Despite a Zacks Rank #3 (Hold), signaling market alignment in the near term, investors should tread carefully, considering both short-term volatility and long-term potential.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah