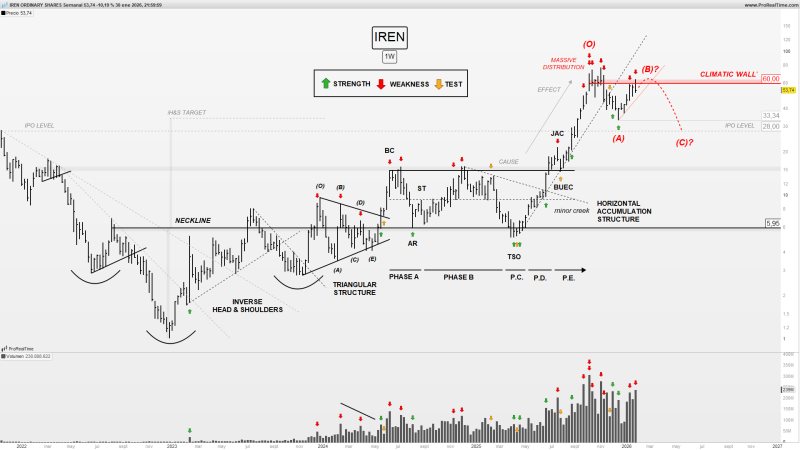

⬤ Iris Energy shares got rejected at the $60 zone again on the weekly chart, marking another failure to push through this critical resistance level. Price couldn't hold above this threshold despite strong momentum leading into it, with sellers stepping in right at the same spot. The repeated bounce-backs from $60 show this level is acting as a major ceiling for the stock right now.

⬤ Looking at the bigger picture on the weekly timeframe, IREN built a solid base through accumulation before breaking out and rallying hard toward $60. But every time price touches that upper boundary, it gets smacked down. Multiple rejection points cluster around this level, proving that bulls can't sustain moves beyond it despite earlier strength from the lows.

⬤ Volume tells the same story—heavy activity came in during the run-up and near the highs, but distribution patterns emerged as price struggled at resistance. "The repeated reaction at $60 highlights its importance in defining the current phase of the stock's price structure," showing that momentum has clearly stalled at this zone. While the longer-term advance from prior lows is still intact, recent weekly candles show hesitation rather than continuation.

⬤ All eyes turn to Thursday's earnings release, which could be the catalyst that finally breaks this standoff at $60. When price sits right at a climactic level like this, earnings volatility often decides the next major move. The market's reaction after the report drops will reveal whether $60 keeps acting as a ceiling or if IREN can finally push through and hold higher ground.

Usman Salis

Usman Salis

Usman Salis

Usman Salis