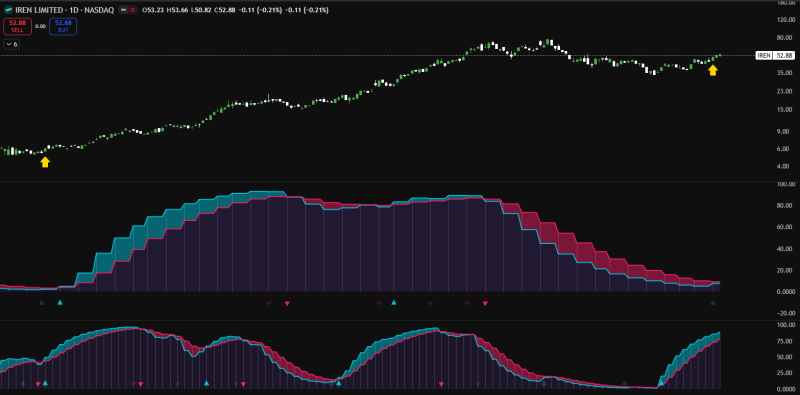

⬤ IREN Limited (IREN) is trying to push higher after defending the $50 support zone, with momentum indicators suggesting the pullback might be over. The stock's currently trading around $52.88, grinding higher after a brief consolidation that let some of the heat come out of the rally.

⬤ Two momentum oscillators on the daily chart just lined up in a pattern that's worth paying attention to. The last time these stochastics showed this exact setup, IREN went on an absolute tear—climbing from around $6 all the way to $75 over several months. Nobody's saying that's happening again, but the indicators are clearly resetting and pointing back up after getting stretched.

⬤ The price chart looks healthy too. IREN's still printing higher lows even with the recent pause, and it's already up more than 5% since bouncing off that $50 level. The momentum readings in the lower panels are climbing out of oversold territory, which typically means there's room to run rather than signs of exhaustion.

⬤ What makes this interesting is how the stock managed to cool off without breaking down. Holding support while indicators reset is exactly what you want to see in a working uptrend. Whether this leads to another leg up depends on volume confirmation and follow-through, but the technical setup is lining up nicely for bulls watching IREN.

Peter Smith

Peter Smith

Peter Smith

Peter Smith