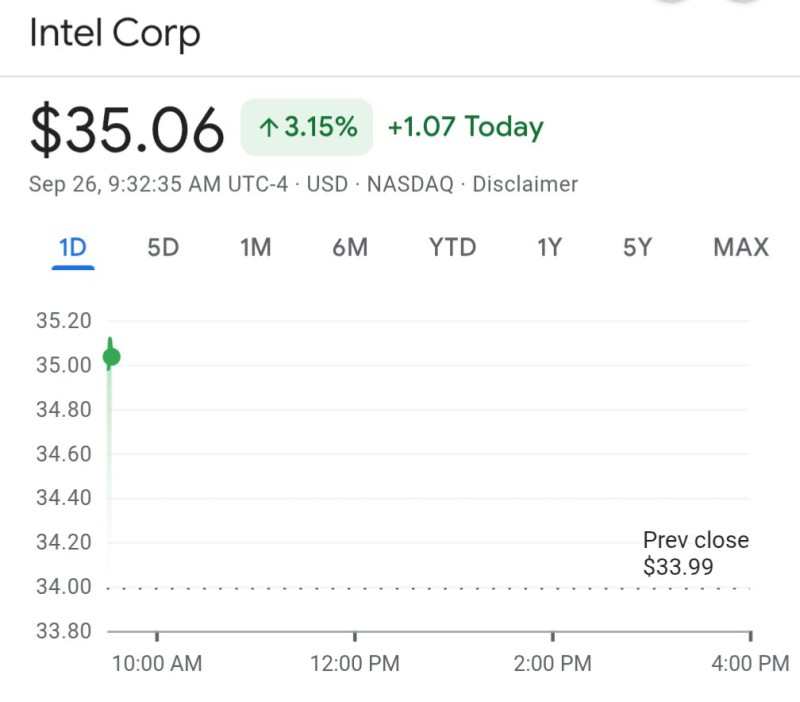

Intel's stock jumped above the crucial $35 threshold during early trading, catching the attention of both institutional investors and retail options traders. With options contracts set to expire today, this price level has become a focal point that could influence how traders view Intel's immediate prospects.

Key Market Movements

Intel shares climbed 3.15% to reach $35.06, moving up from yesterday's close of $33.99. This breakout is particularly meaningful for options traders, including notable market participant Dividend Diplomats, who are holding call options at the $35 strike. If the stock closes above $35.01, these contracts will be exercised, demonstrating how specific price levels can have real financial consequences for short-term traders.

The technical picture shows several encouraging signs. The stock cleared the $35 resistance barrier right at market open, suggesting renewed buying interest. Yesterday's closing price of $33.99 now acts as nearby support, while the gap higher indicates growing enthusiasm for Intel shares, possibly reflecting broader optimism in the semiconductor space. However, today's options expiration could lead to increased volatility as the session progresses.

What's Driving the Move

Several factors appear to be supporting Intel's rally. The semiconductor sector has been benefiting from strong demand tied to artificial intelligence applications and data center expansion. Intel's ongoing corporate restructuring efforts, aimed at better competing with rivals like NVIDIA and AMD, have also drawn investor attention. Additionally, the concentration of expiring options contracts at the $35 strike price has likely amplified both trading volume and price movement.

Looking Ahead

The stock's closing price will be critical. If Intel can maintain levels above $35, it might open the door for a move toward the $36-$37 range. Conversely, if the stock falls back below $35, it would reinforce the idea that this level remains a significant hurdle. Today's trading around $35 represents more than just technical analysis – it's a real-time test of whether investors truly believe in Intel's turnaround efforts as we head into the fourth quarter.

Peter Smith

Peter Smith

Peter Smith

Peter Smith