● Analyst Wilk z T29 recently highlighted signs that Intel Corporation ($INTC) is regaining its footing. "More and more signals show Intel is truly starting to recover. A major AI client. Factories mostly outside China, giving stability advantages. A strategic government partnership now holds nearly 10% of shares," the analyst noted, emphasizing Intel's blend of innovation and geopolitical positioning.

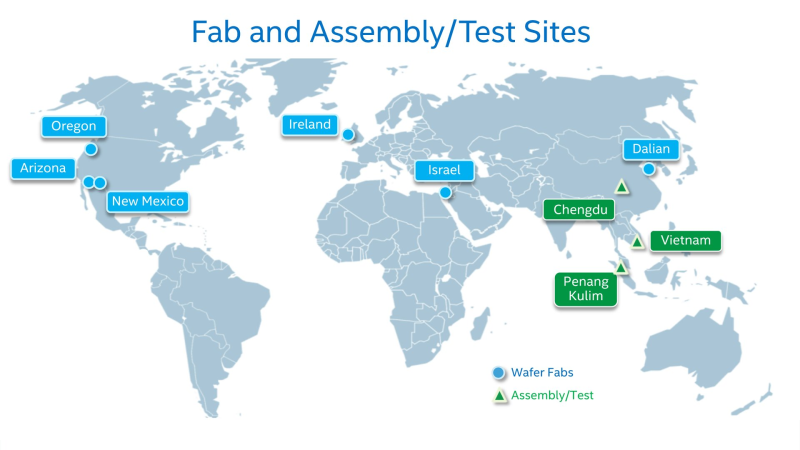

● Intel's growth hinges on reorganizing global chip production. By expanding fabs in the U.S. (Oregon, Arizona, New Mexico) and Europe (Ireland, Israel), while keeping limited Asian presence (Dalian, Chengdu, Penang, Kulim, Vietnam), Intel cuts reliance on China-based manufacturing—crucial amid supply chain tensions. Yet risks remain: construction delays, capital pressure, and engineer shortages could slow expansion.

● Intel's alignment with U.S. programs like the CHIPS Act brings substantial funding and policy support. Public investment could reach roughly 10% of Intel's total fab capital. While this partnership secures long-term capacity, critics worry about political influence and compliance costs. Some advocate for performance-based tax credits and innovation grants instead to boost profitability and attract private investment rather than state equity.

● Intel's diversification strategy creates thousands of high-skilled jobs and stabilizes tax revenues across the U.S., Europe, and Southeast Asia. The expansion strengthens Western resilience in AI and data processing supply chains, supporting national and corporate tech ambitions.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah