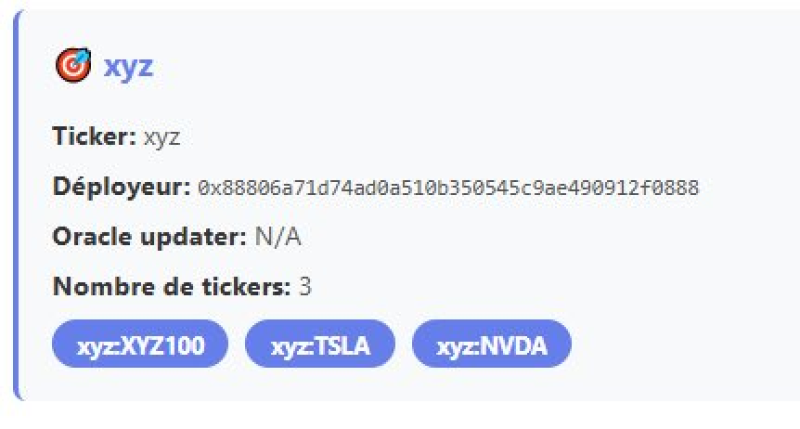

● Analyst Kook recently dropped a tweet revealing that Hyperliquid has officially rolled out equity tickers for Tesla (TSLA)andNvidia(TSLA) and Nvidia ( TSLA)andNvidia(NVDA) using its xyz protocol. The data he shared shows the xyz deployer address (0x88806a71d74ad8a510b350545c9ae490912f8888) now lists three tickers: xyzXYZ100, xyzTSLA, and xyzNVDA—proof that these assets are actually live on Hyperliquid Core.

● This is a pretty big deal when it comes to bringing real-world stocks into on-chain trading. In his post, Kook pointed out why this matters to him personally:

"Kook Capital has hard shilled only two equity tickers for years — $TSLA and $NVDA — and they are the first two equities added to Hyperliquid. Must mean something.

● What we're seeing here is decentralized exchanges pushing past crypto-only trading. Now traders can get synthetic exposure to stocks like Tesla and Nvidia without going through traditional brokers. These assets live on-chain under the xyz framework, using smart contracts that mirror real-world price movements while keeping all the transparency and flexibility that blockchain offers.

● Some experts think this could set the tone for tokenized equity trading going forward—basically building a bridge between DeFi and global stock markets. By bringing popular, high-volume stocks like TSLA and NVDA onto the blockchain, Hyperliquid might enable round-the-clock, borderless trading that traditional markets just can't match.

● Adding these tickers also reinforces Hyperliquid's position as a DeFi innovator, mixing traditional financial assets with on-chain accessibility. As Kook put it, this could be the start of something bigger—an era where regular stocks trade side-by-side with digital assets, completely changing how we think about markets and liquidity.

Usman Salis

Usman Salis

Usman Salis

Usman Salis