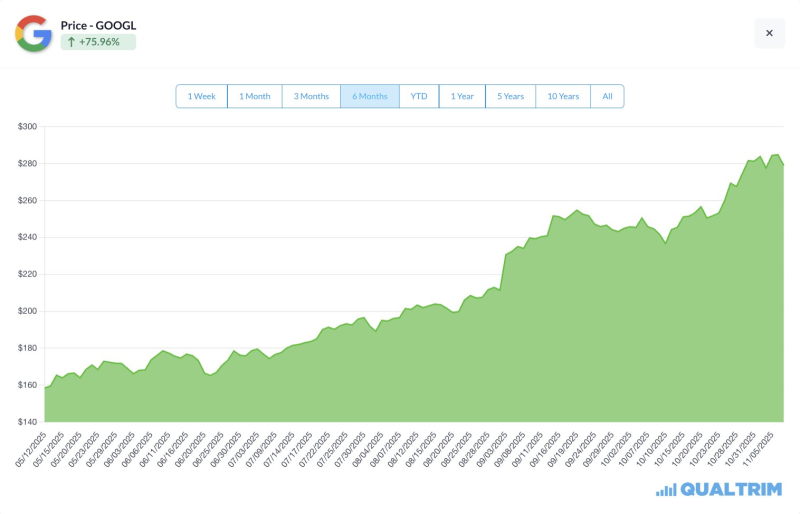

⬤ A powerful reminder from Bill Ackman: "Investing is a business where you can look very silly for a long period of time before you are proven right." The timing couldn't be better—GOOGL has climbed over 75% year-to-date, moving from around $150 to nearly $290. The chart tells a clear story: staying disciplined beats chasing short-term moves.

⬤ Of course, the backdrop isn't entirely rosy. Governments worldwide are floating new capital gains tax proposals that could cut into returns, push talent toward lower-tax regions, and squeeze smaller investors. They're part of the reality every major stock—including GOOGL—now faces.

⬤ Ackman's message resonates because it captures what actually works: conviction plus patience. GOOGL's steady climb from $150 to $280-290 shows that investors who held through the bumps are now being rewarded. Sometimes looking "silly" for a while is just part of the process.

⬤ As GOOGL continues its strong run, the takeaway seems clear. Despite tax worries and regulatory changes, the stock's performance backs up the point: solid long-term strategies tend to win out, especially in fast-moving tech markets where knee-jerk reactions rarely pay off.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova