The Federal Reserve maintains current interest rates (USINTR) while revising economic projections amid uncertainty over Trump's tariff policies.

Fed Keeps USINTR Unchanged Amid Economic Uncertainty

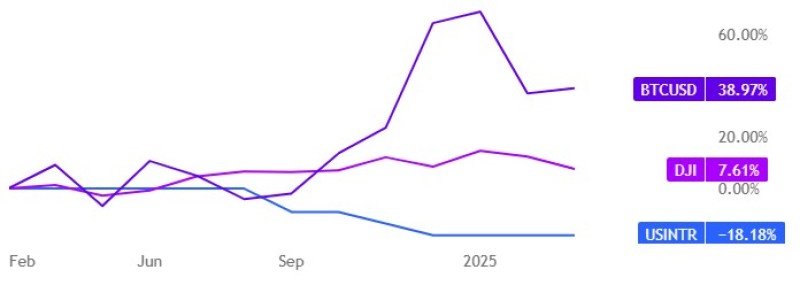

The Federal Reserve has maintained its steady stance on interest rates (USINTR), keeping borrowing costs unchanged at 4.5% as it concluded its two-day regular policy meeting. This decision aligns with analyst expectations, though the central bank did update its forward-looking guidance in a move that markets had partially anticipated. Despite the steady rates, the economic projections revealed a more cautious outlook, with 11 out of 19 Fed officials now expecting two cuts to interest rates this year, while only two officials advocated for three rate reductions.

USINTR Projections Reflect Trump Tariff Concerns

The Fed's revised economic projections show increased inflation expectations, largely attributed to uncertainty surrounding Trump's tariff policies. Inflation forecasts were adjusted upward to 2.7% for this year, an increase from the previous 2.5% projection made in January. Federal Reserve bankers anticipate that inflation will gradually ease back toward their target rate of 2% by 2026 and 2027. Meanwhile, expectations for GDP growth—a key indicator closely monitored by market participants—have been downwardly revised to 1.7% for 2025, down from the previous projection of 2.1%.

Market Reactions Positive Despite USINTR Holding Pattern

Markets responded favorably to Powell's message despite the unchanged USINTR. The Dow Jones Industrial Average (DJI) surged approximately 500 points during the Federal Reserve chairman's speech. Similarly, the S&P 500 and the Nasdaq Composite showed strong gains, adding 1.4% and 1.8% respectively. The US dollar also strengthened somewhat, though only recovering a small portion of what it had lost in previous trading sessions.

Cryptocurrencies Rally Following USINTR Decision

The cryptocurrency market joined the positive market sentiment following the Fed's decision to hold interest rates (USINTR) steady. Bitcoin (BTCUSD) rose 3.5%, breaking through the $86,000 threshold after hovering near $82,000 for several days. Ethereum performed even better, climbing approximately 6% to surpass $2,000 per coin and reaching a session high of $2,070.

Federal Reserve officials find themselves in a challenging position as they navigate the unpredictable policy environment created by the Trump administration. The uncertainty surrounding potential tariff implementations is complicating the central bank's ability to plan future monetary policy moves and accurately forecast economic changes related to inflation, growth, and employment conditions.

Despite maintaining current interest rate levels, the Fed's revised projections signal a more cautious approach to monetary policy in the coming months. The reduction in projected rate cuts for 2025 indicates the Federal Reserve's growing concern about inflation persistence, even as they balance this against the risk of economic slowdown.

The positive market reaction suggests investors are taking comfort in the Fed's measured approach, appreciating the central bank's willingness to maintain stability while acknowledging the complex economic factors at play. The rise across all three major indexes demonstrates market confidence in the Fed's current strategy, despite the reduced expectations for monetary easing.

For cryptocurrency markets, the Fed's steady hand appears to have provided sufficient certainty to encourage renewed buying interest. Bitcoin's push past $86,000 and Ethereum's strong performance above $2,000 indicate that digital asset investors view the current monetary policy environment as supportive of continued growth in the crypto sector.

As economic indicators continue to evolve and policy uncertainties persist, market participants will be closely monitoring future Fed communications for any shifts in tone or projection that might signal changes to the anticipated rate cut trajectory for the remainder of the year.

Usman Salis

Usman Salis

Usman Salis

Usman Salis