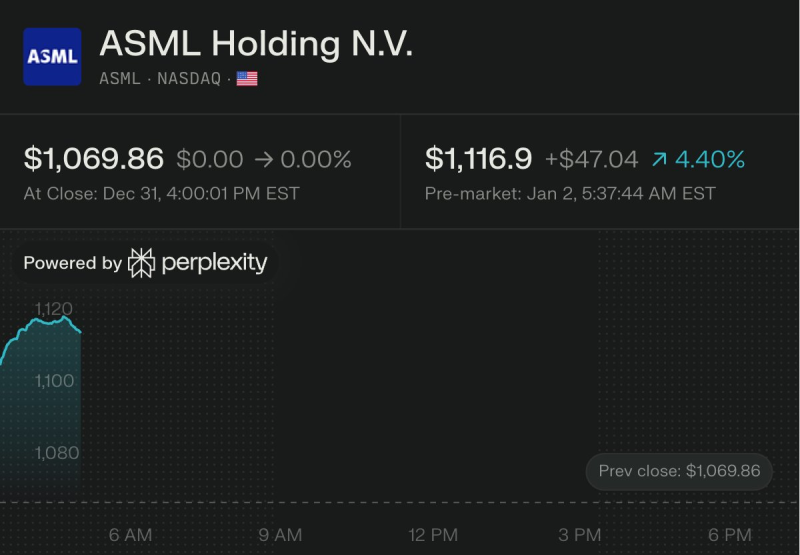

⬤ ASML Holding N.V. closed at $1,069.86 on December 31, then jumped to around $1,116.90 in pre-market trading on January 2—that's a solid 4.40% gain. Aletheia Capital made waves by issuing a rare double upgrade on ASML, moving it straight from Sell to Buy while nearly doubling its price target from $750 to $1,500. The firm's reasoning? They've bumped up their FY2026 and FY2027 earnings estimates, anticipating a fresh wave of investment expansions and capacity upgrades throughout the semiconductor industry.

⬤ Aletheia's got high hopes for ASML's extreme ultraviolet lithography tools, particularly from DRAM suppliers who are expected to ramp up demand. They're also counting on China to keep buying deep ultraviolet systems throughout FY2026. But here's where it gets really interesting—Taiwan Semiconductor Manufacturing Company is set to become a major growth driver in FY2027. TSMC alone could install between 40 and 45 EUV tools as the company expands its advanced production capacity by 40 to 50%. That kind of deployment would push total EUV unit demand to somewhere around 75 to 80 systems, which is pretty much maxing out ASML's full capacity.

⬤ With these projections in mind, Aletheia expects ASML's Low-NA EUV revenue to climb by roughly one-third in FY2026, then really take off with another 50 to 60% jump in FY2027. What's fueling this growth? Higher shipment volumes combined with a more premium product mix. According to their calculations, this translates to overall sales growth in the mid-teens for FY2026 and mid-twenties for FY2027—numbers that are actually ahead of both ASML's own guidance and what most analysts are expecting. It's clear the firm sees renewed momentum building in capital spending across memory manufacturing and cutting-edge foundry capacity.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi