When most investors run for the exits during market turbulence, Cathie Wood's Ark Invest does exactly the opposite. The investment firm just made headlines by scooping up nearly $50 million worth of crypto-related stocks right as the sector was getting hammered. It's a classic contrarian play that's got everyone talking about whether this signals the bottom or if there's more pain ahead.

Ark Invest Sees Opportunity Where Others See Risk

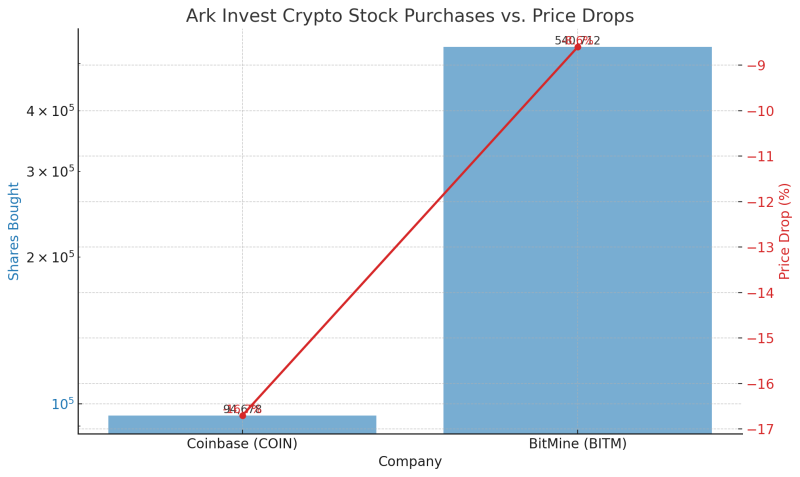

While crypto stocks were taking a beating this week, Ark Invest decided to go shopping. The firm dropped $47 million on two major plays: grabbing 94,678 shares of Coinbase (COIN) for about $30 million and picking up 540,712 shares of BitMine Immersion Technologies (BITM) worth roughly $17 million.

These purchases were spread across Ark's flagship ETFs - ARKK, ARKW, and ARKF - showing this wasn't just a small speculative bet but a coordinated institutional move. What makes this timing so interesting is that both stocks had just taken serious hits. Coinbase was down 16.7% and BitMine dropped 8.6% after earnings reports that left investors disappointed.

But instead of waiting for the dust to settle, Wood's team treated the selloff like a clearance sale. It's the kind of aggressive buying that either looks brilliant in hindsight or becomes a cautionary tale about catching falling knives.

BitMine's Massive Ethereum (ETH) Holdings Drive Strategic Value

Here's where things get really interesting with the BitMine purchase. This isn't just any crypto stock - BitMine is sitting on the largest public Ethereum treasury in the world, holding 625,000 ETH tokens.

That's a massive bet on Ethereum's future, and Ark clearly sees value in getting exposure to ETH through BitMine's stock. For investors exploring blockchain-related opportunities that also align with ethical investment guidelines, checking a halal stocks list could highlight similar companies with compliant profiles.

The company's enormous Ethereum (ETH) stash makes it essentially a leveraged play on the world's second-largest cryptocurrency. When ETH price moves up, BitMine's value should theoretically follow suit. Ark's decision to load up on BITM shares during this dip suggests they're betting that Ethereum's current weakness is temporary.

This move fits perfectly with Ark's reputation for making big, long-term infrastructure bets. They're not just buying crypto stocks - they're positioning themselves for what they believe will be the next wave of blockchain adoption and growth.

What This Means for Ethereum (ETH) Price Outlook

Ark's $47 million shopping spree sends a pretty clear message to the market: institutional money still believes in crypto's long-term story. While retail investors might be getting shaken out by the recent volatility, sophisticated players like Ark are using the weakness to build bigger positions.

The fact that they're doubling down on both direct crypto exchange exposure through Coinbase and indirect Ethereum (ETH) exposure through BitMine shows they're not putting all their eggs in one basket. It's a diversified bet on the entire crypto ecosystem bouncing back stronger.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah