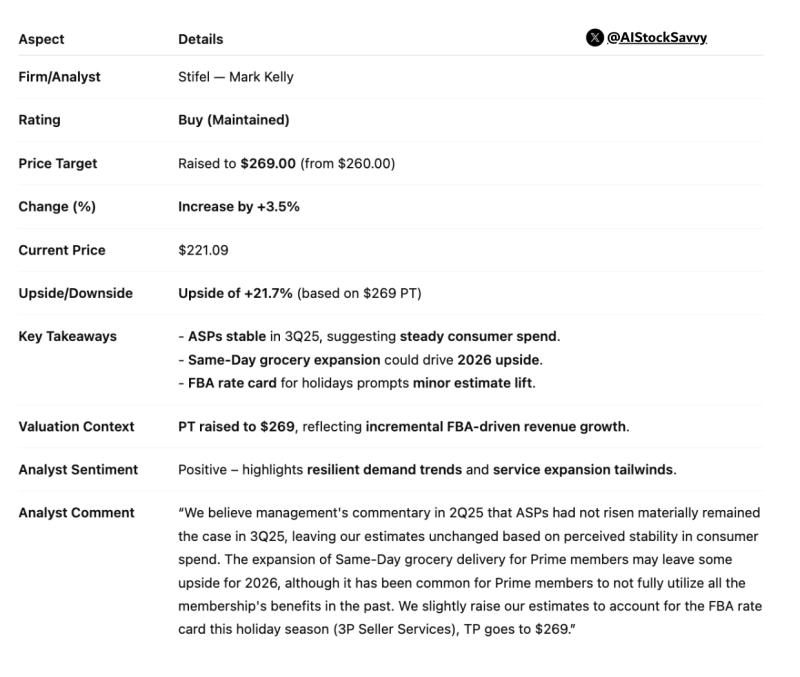

Amazon (AMZN) received another bullish signal from Wall Street as Stifel analyst Mark Kelly raised the price target to $269 from $260 while maintaining a Buy rating. The upgrade highlights resilient consumer demand, growing Fulfillment by Amazon (FBA) services, and expanding Same-Day grocery delivery as key growth drivers.

Stable Spending and Service Expansion Drive Momentum

Trader Hardik Shah recently shared Stifel's updated research note showing Amazon's average selling prices held steady through Q3 of fiscal 2025. This consistency suggests shoppers remain engaged despite mixed retail conditions. Amazon appears to be capturing share from both traditional and online competitors without raising prices or seeing demand soften.

The Same-Day grocery delivery program is drawing analyst attention as Amazon expands faster delivery to more Prime members. Stifel expects this initiative to boost 2026 performance while FBA pricing adjustments during the holiday season should provide a modest revenue lift and improve margins.

Valuation and Analyst View

Stifel's $269 target reflects expected revenue growth from FBA and service improvements. With shares trading around $221, this implies roughly 22% upside potential. Key factors supporting the outlook include:

- Steady consumer spending without price increases

- Expanding Same-Day grocery delivery for Prime members

- Holiday-driven FBA pricing adjustments

- Continued market share gains across retail channels

Looking Ahead

Amazon's focus on faster delivery, broader grocery access, and consistent Prime engagement creates a solid foundation for growth. Analysts believe operational efficiency across logistics and seller services will support revenue and margin expansion through 2026, positioning Amazon well among large-cap tech stocks.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah