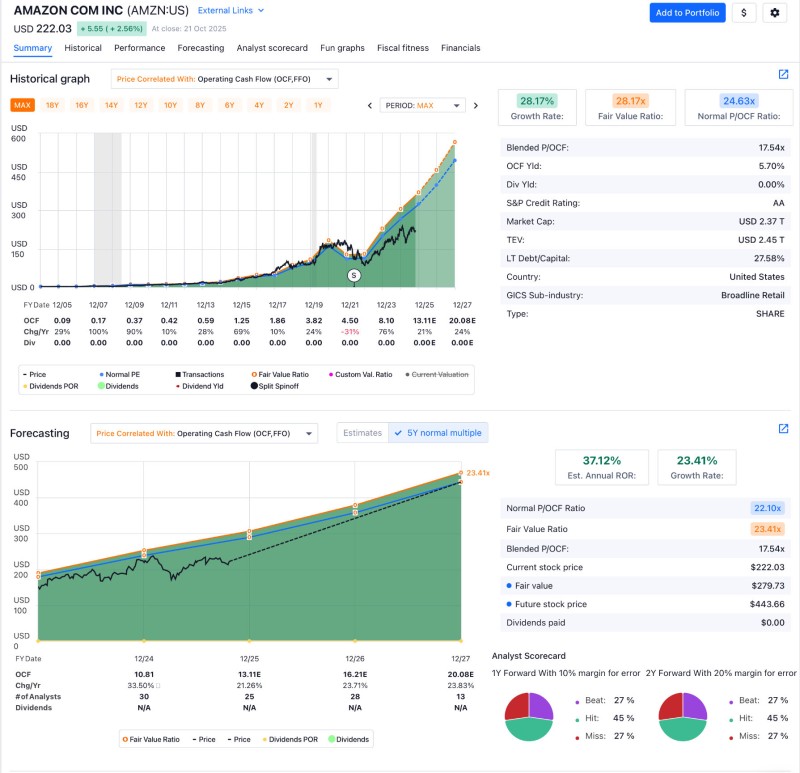

Amazon (AMZN) is setting up for a significant revaluation. Trading around $222 per share, the stock reflects its lowest Price-to-Operating Cash Flow ratio since 2023, when shares bottomed near $90. This valuation compression presents a compelling opportunity as the company's fundamentals remain strong.

Amazon's Valuation Signals Major Upside Potential

Market analyst Austin Lieberman, who predicted rallies in Meta and Google, believes Amazon may be next for a major recovery.

The company's Operating Cash Flow Yield stands at 5.7%, while its Fair Value multiple of 23.4x suggests over 25% undervaluation. Analysts forecast average annual returns exceeding 37% over the next three years, levels typically seen in early bull cycles.

Chart Analysis: Historical Undervaluation Meets Growth Momentum

Amazon's historical chart shows steady cash flow generation since 2007, with brief valuation resets followed by sustained growth. The current P/OCF multiple of 17.5x sits well below the historical norm near 24x. Operating Cash Flow is projected to nearly double from $10.8B in FY2024 to $20.8B by FY2027, a compound annual growth rate exceeding 20%. If this trajectory holds and the market re-rates the stock toward fair value, shares could reach $440–$450 within three years.

AWS and AI: The Engines of the Next Expansion Cycle

Key growth drivers include:

- AWS delivering high-margin revenue amid surging AI and cloud demand

- AI-driven automation across warehouses, logistics, and inventory management

- Billions in projected OPEX savings over the next 24 months

- Expanding enterprise adoption of AWS for AI model training and deployment

Amazon Web Services remains the cornerstone of the company's valuation story, capturing market share while benefiting from explosive AI infrastructure demand. Amazon's deployment of AI-driven automation throughout operations is expected to generate substantial cost savings. From warehouse robotics to logistics optimization, these initiatives position the company to significantly improve margins while maintaining growth. These operational gains, combined with AWS's AI-led expansion, could establish Amazon as the next major AI beneficiary following Meta and Google's rebounds.

Why Amazon's Setup Appeals to Long-Term Investors

Amazon's current situation offers an unusual combination of low relative valuation, high growth visibility, and powerful secular tailwinds in AI and automation. With an AA credit rating, $2.37 trillion market cap, and a decade-long track record of compounding cash flows, the company maintains one of tech's strongest balance sheets. Its strategy of forgoing dividends in favor of reinvestment into AI infrastructure and fulfillment innovation supports sustainable long-term growth.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir