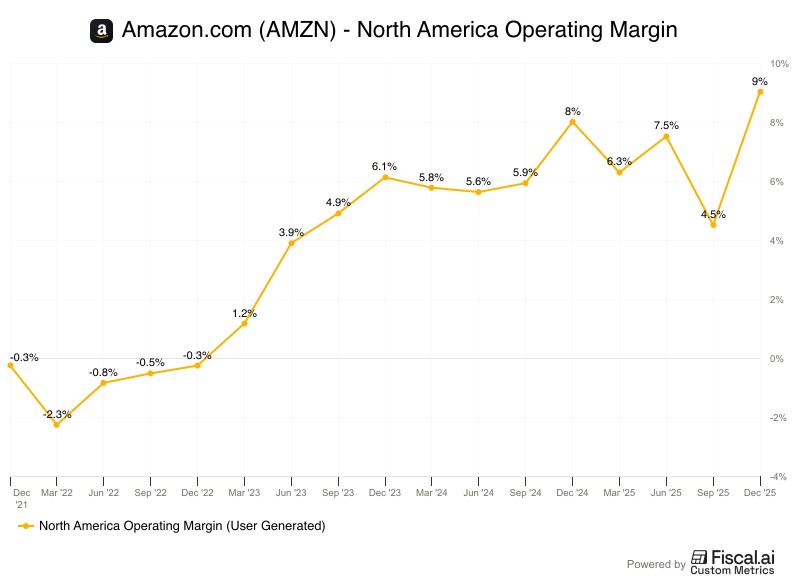

⬤ AMZN North America operating margin climbed to around 9%, marking the strongest profitability level the segment has ever seen. The company's e-commerce operations keep getting more efficient even as it pours money into logistics and automation.

⬤ The numbers tell a compelling story. Back in 2022, margins actually dipped below −2%. But since then, we've seen a steady climb: past 3% by 2023, pushing toward 6% through 2024, and finally hitting roughly 9% by late 2025. This isn't just a lucky quarter—it's a fundamental shift. Amazon's retail business is moving from a razor-thin-margin scale model to something that actually makes serious money. This improvement ties directly into the automation push, which has been covered in AMZN expands AI-driven logistics.

⬤ What's remarkable here is that Amazon's retail margins are now approaching levels you'd expect from mature tech platforms, not traditional retailers. For years, the segment bounced between losses and low single digits while Amazon built out massive infrastructure. Now that investment is paying off—scale and fulfillment technology are cutting costs per order. Analysts have been watching this closely, similar to discussions in Amazon stock analysis conservative strategy amid key levels.

⬤ This 9% milestone signals something bigger. Amazon isn't just chasing growth anymore—it's proving it can actually run a profitable retail operation at scale. If these margins hold, it could reshape how markets view large retail platforms, especially when it comes to efficiency, pricing power, and long-term competitive edge. The era of "growth at any cost" might finally be giving way to sustainable, margin-driven expansion.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah