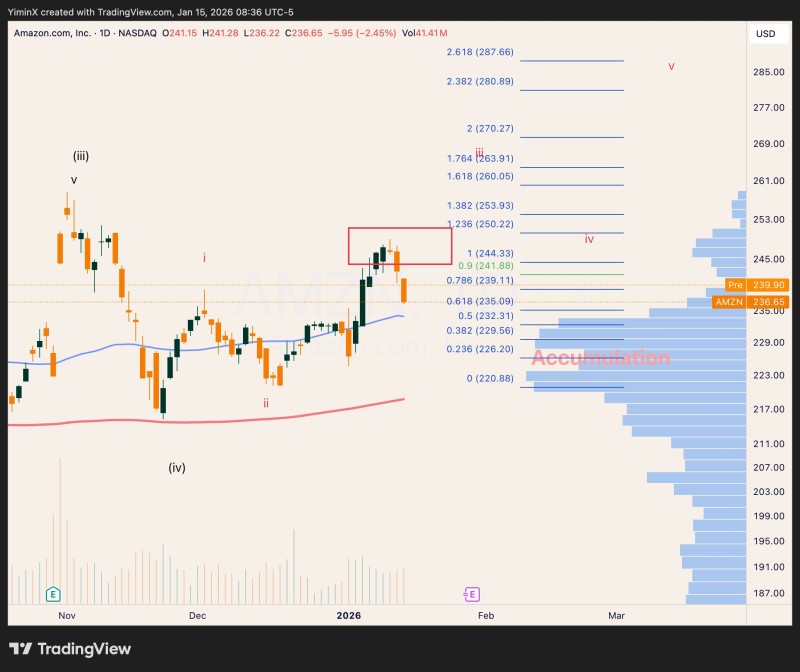

⬤ Amazon stock has pulled back recently, raising questions about whether this is just a temporary dip or something more serious. The good news? The stock is still holding above its 50-day moving average, which often acts as a safety net during pullbacks. The $230 level has become a battleground, with solid trading volume showing plenty of interest from buyers at this price.

⬤ Right now, the chart tells an interesting story. As long as Amazon stays above $230, the bulls still have a shot at pushing higher. But there's a line in the sand at $225—if the stock breaks below that, it could open the door to a deeper selloff. That's the level everyone's watching.

⬤ The current setup looks like what traders call a bull trap—where the stock dips to shake out weak hands before potentially resuming its climb. The fact that Amazon hasn't cracked below its 50-day moving average is encouraging. But make no mistake, if $225 gives way, the next stop could be significantly lower.

⬤ For now, Amazon is holding its ground above both the 50-day moving average and that crucial $230 support. Bulls are hoping this floor holds firm, while bears are eyeing $225 as the trigger for a bigger move down. The next few trading sessions will likely tell us which side wins this tug-of-war.

Peter Smith

Peter Smith

Peter Smith

Peter Smith