⬤ Amazon's advertising division has quietly evolved into a digital advertising giant. According to Shay Boloor, the segment currently runs at an estimated $85 billion annual revenue run rate, putting AMZN alongside the world's dominant advertising platforms.

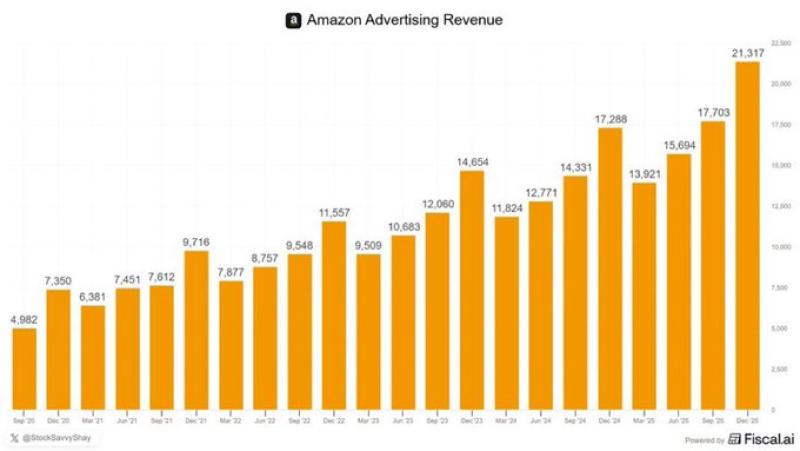

⬤ The numbers tell a compelling growth story. Quarterly revenue has climbed from around $5 billion to over $21 billion in recent periods, showing consistent upward momentum rather than sporadic jumps. This steady progression signals that advertising isn't just a side business for Amazon—it's become a core pillar of the company's revenue engine. The trajectory builds on earlier milestones covered in Amazon advertising revenue hits $60B fastest-growing segment and Amazon advertising revenue nears $69B milestone.

As analyst Shay Boloor noted, The recurring increases indicate ongoing adoption of advertising tools integrated into Amazon's commerce ecosystem.

⬤ The platform continues expanding at approximately 23% year over year. Unlike traditional ad networks, Amazon's advertising success stems from its unique position—brands can advertise directly where consumers shop, creating a closed loop from impression to purchase. This competitive edge has reshaped the digital advertising landscape, as explored in Amazon hidden cash cow advertising revenue explodes past AWS growth.

⬤ The growth reflects a broader shift in Big Tech business models. Major platforms increasingly depend on advertising revenue to complement their primary services. For Amazon, this means advertising now rivals AWS as a profit driver, fundamentally changing how the company competes in global digital advertising markets. The $85 billion run rate positions AMZN as a serious challenger to Google and Meta's long-standing duopoly.

Peter Smith

Peter Smith

Peter Smith

Peter Smith