The AI chip battle just got more interesting. AMD stunned investors with a 27% stock surge after announcing a significant partnership with OpenAI. This deal breaks OpenAI's heavy dependence on Nvidia and puts AMD squarely in the fight for AI computing dominance. Wall Street is betting this partnership could fundamentally change AMD's business and fuel massive growth.

What the Deal Looks Like

According to App Economy Insights, here's what OpenAI committed to:

- Deploying 6 gigawatts of AMD's Instinct GPUs, starting with 1 GW in late 2026 using the MI450 chips

- Potentially taking up to 10% equity in AMD

- Creating what analysts project could be tens of billions in revenue for AMD over the life of the agreement

This isn't just a purchase order. It's OpenAI betting big on AMD's technology becoming a cornerstone of AI infrastructure worldwide.

Revenue Picture: Where AMD's Growth Really Is

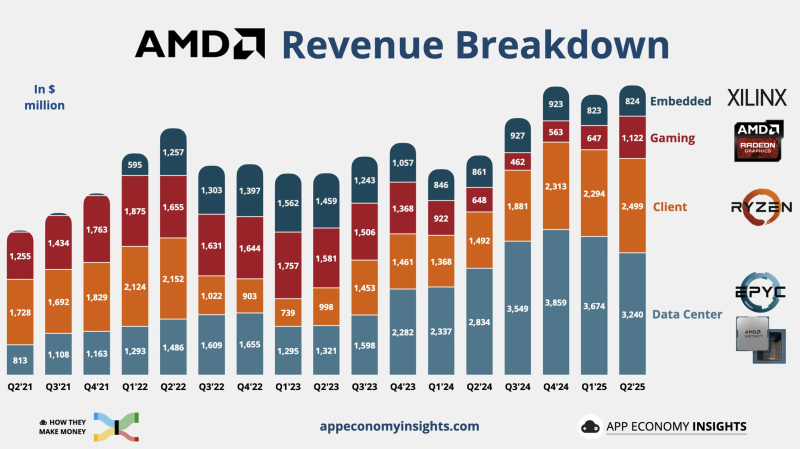

Looking at AMD's revenue mix shows why this matters so much. Data center sales have been climbing steadily and are hitting new peaks in 2025. Meanwhile, gaming revenue has basically flatlined since 2022, and client chip sales (like Ryzen CPUs) bounce around with PC market cycles. The embedded business from Xilinx is steady but not explosive. The bottom line? AMD's future growth lives in data centers, and that's exactly where this OpenAI deal hits.

Why Investors Should Care

This partnership changes AMD in three big ways. First, it validates that AMD's Instinct chips can actually compete with Nvidia's dominance in AI accelerators. Second, it gives AMD a massive new revenue stream that doesn't depend on the ups and downs of PC or console sales. Third, OpenAI potentially owning a piece of AMD creates real skin-in-the-game alignment for the long haul.

Usman Salis

Usman Salis

Usman Salis

Usman Salis