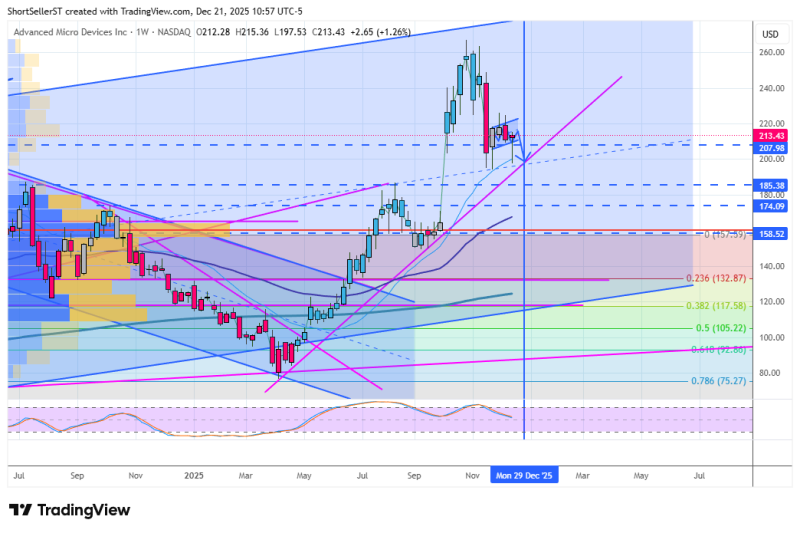

⬤ Advanced Micro Devices (AMD) wrapped up the week on a positive note, closing around $213 with a modest uptick that suggests some near-term stability. The weekly candle looked decent on the surface, but the bigger picture still screams bear flag—a pattern that typically forms when consolidation follows a sharp move and traders start questioning where the stock heads next.

⬤ After surging past $250 earlier this year, AMD pulled back and has been grinding sideways ever since. The chart shows price bouncing around inside a rising channel, with clearly marked support zones at $207, $185, and $158. These levels represent spots where buying and selling activity previously clustered, making them important reference points for what comes next.

⬤ Momentum indicators aren't giving clear signals either way right now. The downside pressure has backed off, but bulls haven't stepped in with conviction yet. Moving averages are flattening out rather than curving higher, which keeps AMD stuck in consolidation mode. While the immediate bearish outlook has softened, there's no confirmation of a trend reversal or fresh bullish momentum building.

⬤ What happens next matters for the entire semiconductor sector since AMD carries significant weight. A clean break above resistance could flip sentiment and trigger renewed buying interest. But if consolidation drags on, traders will stay focused on downside risk management. With price sandwiched between well-defined zones, the next sustained move will likely shape expectations not just for AMD, but for tech stocks more broadly.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets