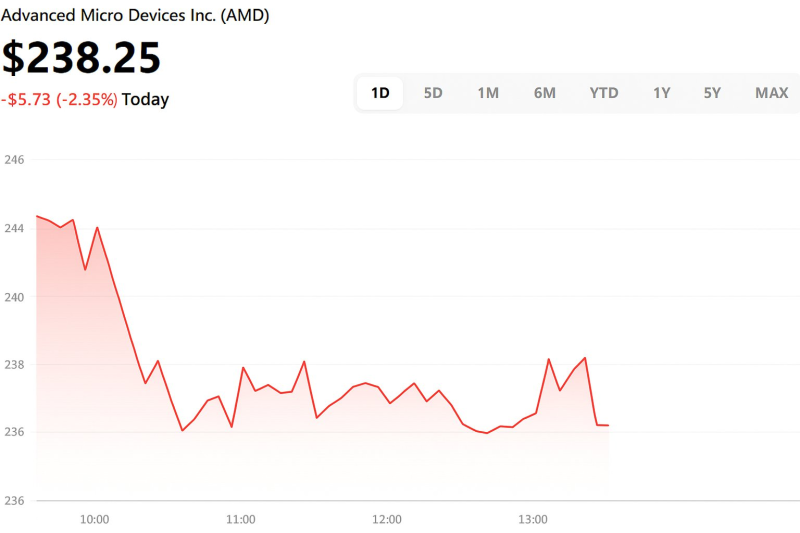

⬤ AMD's data center business pulled in roughly $4.3 billion in Q3 FY2025—marking about 22% year-over-year growth. The stock is currently trading near $238, down over 2% on the day, but still holding within the $225–$240 range that many see as a potential accumulation zone. Despite the short-term pressure, the chart shows no technical breakdown, suggesting the bottom might be forming before a fresh move higher.

⬤ Meanwhile, policy discussions around corporate tax changes—including higher brackets and revised multinational earnings rules—are adding some uncertainty. While not AMD-specific, these proposals could hit high-growth tech companies with tighter margins and potentially slow innovation. For semiconductor firms racing to dominate the AI hardware space, it's one more variable to watch.

⬤ If AMD breaks out on strong volume, the next major targets sit around $300 and $330. The key question for investors: can AMD actually challenge Nvidia's dominance in the next wave of AI infrastructure spending, or will short-term sentiment keep dragging the price around? The chart suggests patience might pay off—the stock is building a base, not falling apart.

⬤ With global demand for AI accelerators, data center compute, and advanced packaging heating up, AMD's improving fundamentals put it in a solid position to grab a bigger slice of enterprise and cloud buildouts. Strong revenue growth, stable price action, and surging industry investment make AMD one to watch as the next phase of the AI cycle unfolds.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah